ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

$149.99$275.00

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

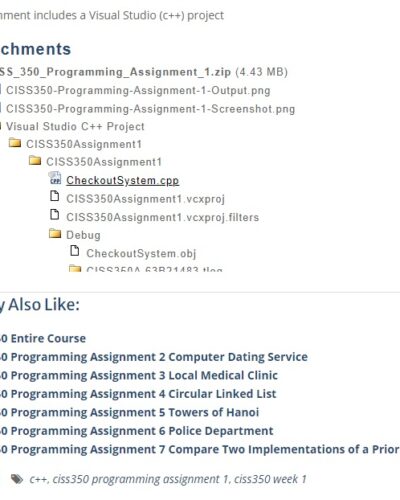

ACC 561 Entire Course (With Final Guide)

Final Guide contains 23 Questions out of 30 (you can ask for free help before opening the exam)

ACC 561 Final Exam Guide (New, 2017, 23 Questions)

ACC 561 Week 1 Individual Assignment Financial Statements (2 Papers) (New Syllabus)

ACC 561 Week 1 Individual Assignment Financial Statements (Walt Disney)

ACC 561 Week 2 Assignment Accounting Methods (Bizcon, 2 Papers)

ACC 561 Week 3 Assignment Ratio Analysis (P Jason, New Syllabus)

ACC 561 Week 3 Team Financial Statement Analysis and Decision Making Activity

ACC 561 Week 4 Assignment Production Cost (Davis Skaros, New Syllabus)

ACC 561 Week 5 Team Cost Behavior Analysis

ACC 561 Week 5 Assignment Case Study Cost Volume Profit Analysis (Mary Willis, New Syllabus)

ACC 561 Week 6 Assignment Managerial Analysis Assessment (Green Pasture, New Syllabus)

ACC 561 Week 1 Financial Statement Differentiation Paper (New Syllabus)

ACC 561 Week 2 Small Business Analysis (New Syllabus)

ACC 561 Week 3 Team Assignment Tootsie Roll Industries Inc. Loan Package

ACC 561 Week 3 Business Plan Develop a business plan and financial metrics

ACC 561 Week 4 Costing Methods

ACC 561 Week 5 CVP and Break-Even Analysis

ACC 561 Week 6 Budgets and Decisions making

Description

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

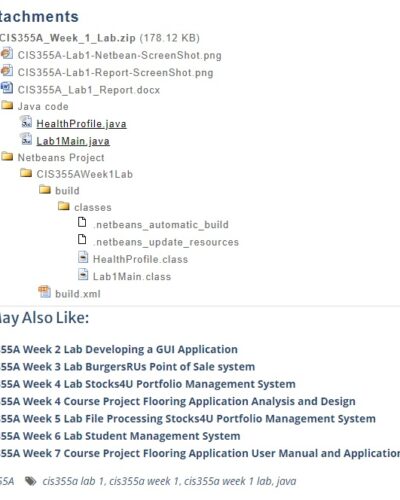

ACC 561 Entire Course (Excluding Final Guide)

ACC 561 Week 1 Individual Assignment Financial Statements (2 Papers) (New Syllabus)

ACC 561 Week 1 Individual Assignment Financial Statements (Walt Disney)

ACC 561 Week 2 Assignment Accounting Methods (Bizcon, 2 Papers)

ACC 561 Week 3 Assignment Ratio Analysis (P Jason, New Syllabus)

ACC 561 Week 3 Team Financial Statement Analysis and Decision Making Activity

ACC 561 Week 4 Assignment Production Cost (Davis Skaros, New Syllabus)

ACC 561 Week 5 Team Cost Behavior Analysis

ACC 561 Week 5 Assignment Case Study Cost Volume Profit Analysis (Mary Willis, New Syllabus)

ACC 561 Week 6 Assignment Managerial Analysis Assessment (Green Pasture, New Syllabus)

ACC 561 Week 1 Financial Statement Differentiation Paper (New Syllabus)

ACC 561 Week 2 Small Business Analysis (New Syllabus)

ACC 561 Week 3 Team Assignment Tootsie Roll Industries Inc. Loan Package

ACC 561 Week 3 Business Plan Develop a business plan and financial metrics

ACC 561 Week 4 Costing Methods

ACC 561 Week 5 CVP and Break-Even Analysis

ACC 561 Week 6 Budgets and Decisions making

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Entire Course (With Final Guide)

Final Guide contains 23 Questions out of 30 (you can ask for free help before opening the exam)

ACC 561 Final Exam Guide (New, 2017, 23 Questions)

ACC 561 Week 1 Individual Assignment Financial Statements (2 Papers) (New Syllabus)

ACC 561 Week 1 Individual Assignment Financial Statements (Walt Disney)

ACC 561 Week 2 Assignment Accounting Methods (Bizcon, 2 Papers)

ACC 561 Week 3 Assignment Ratio Analysis (P Jason, New Syllabus)

ACC 561 Week 3 Team Financial Statement Analysis and Decision Making Activity

ACC 561 Week 4 Assignment Production Cost (Davis Skaros, New Syllabus)

ACC 561 Week 5 Team Cost Behavior Analysis

ACC 561 Week 5 Assignment Case Study Cost Volume Profit Analysis (Mary Willis, New Syllabus)

ACC 561 Week 6 Assignment Managerial Analysis Assessment (Green Pasture, New Syllabus)

ACC 561 Week 1 Financial Statement Differentiation Paper (New Syllabus)

ACC 561 Week 2 Small Business Analysis (New Syllabus)

ACC 561 Week 3 Team Assignment Tootsie Roll Industries Inc. Loan Package

ACC 561 Week 3 Business Plan Develop a business plan and financial metrics

ACC 561 Week 4 Costing Methods

ACC 561 Week 5 CVP and Break-Even Analysis

ACC 561 Week 6 Budgets and Decisions making

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Apply Week 1 Financial Statement L3 Harris Technologies, Inc (May 2020 Syllabus)

Company: L3 Harris Technologies, Inc. Stock Symbol: LHX Open the link to the company’s financial statements. The link is listed under the Resources heading (see below). Review the data included with the income statement, balance sheet, and cash flow tabs.

1. Explain the information provided by each financial statement and include specific examples.

2. Review the accounting data and explain positive or negative trends. How does this impact the business?

3. If you were an investor which financial statement AND accounts would you review? Why?

4. If you were a member of the management team which financial statement AND accounts would you review? Why?

Write a paper between 1,000 to 1,700 words. Format your paper consistent with APA guidelines. Deliverable: Paper (MS Word) Review your Originality Report generated from SafeAssign. A new originality report is created with each attempt. Your last attempt is used for grading.

This is the website for the assignment

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Assignment Week 1 Financial Statements (May 2020) (Two Rivers Inc)

Purpose of Assignment

This activity helps students recognize the significant role accounting plays in providing financial information to management for decision making through the evaluation of financial statements. This experiential assignment requires students to use ratios to evaluate and analyze a company’s liquidity, solvency, and profitability.

Two-Rivers Inc. (TRI) manufactures a variety of consumer products. The company’s founders have run the company for thirty years and are now interested in retiring. Consequently, they are seeking a purchaser, and a group of investors is looking into the acquisition of TRI. To evaluate its financial stability, TRI was requested to provide its latest financial statements and selected financial ratios. Summary information provided by TRI is presented below.

Required:

a. Calculate the select financial ratios for the fiscal year Year 2. (use MS word or excel but excel is more recommended)

b. Interpret what each of these financial ratios means in terms of TRI’s financial stability and operating efficiency.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Discussion Costing Systems

Product costing systems are methods used to manage inventories. Accounting systems primarily engage one of three costing systems at a time: job order costing, process-based costing, or activity-based costing.

Respond to the following in a minimum of 150 words:

- Briefly explain each of the three costing systems in accounting.

- Discuss the situations in which each system would be best employed by a business.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Discussion CVP Analysis

Cost-volume-profit analysis, or CVP, is something companies use to figure out how changes in costs and volume affect their operating expenses and net income. In other words, CVP is a methodical analysis of the dynamic inter-relationship between selling prices, sales and production volume, cost expenses, and profits.

Respond to the following in a minimum of 150 words:

- Explain each of the three elements of CVP analysis.

- Discuss how managers use CVP analysis.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Discussion Organizational Budgets

Shrewdly designed budgets assist businesses leaders with awareness of expenditures and managing resources. Businesses use a variety of budgets to measure their spending and develop effective strategies for maximizing their assets and revenues. Many types of organizational budgets exist and each have different purposes, strengths, and weaknesses.

Respond to the following in a minimum of 150 words:

- Briefly discuss four types of organizational budgets.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Final Exam Guide (New, 2020, Score 100%)

The investigation of materials price variance usually begins in the:

controller’s office.

accounts payable department.

first production department.

purchasing department

Hollis Industries produces flash drives for computers, which it sells for $20 each. Each flash drive costs $13 of variable costs to make. During April, 1,000 drives were sold. Fixed costs for March were $2 per unit for a total of $1,000 for the month. How much is the contribution margin ratio?

35%

25%

75%

65%

Which of the following statements is not true?

When a company’s sales revenue is decreasing, high operating leverage is good because it means that profits will decrease at a slower pace than revenues decrease.

When a company’s sales revenue is increasing, high operating leverage is good because it means that profits will increase rapidly.

Companies that have higher fixed costs relative to variable costs have higher operating leverage.

Operating leverage refers to the extent to which a company’s net income reacts to a given change in sales.

Which of the following will not result in an unfavorable controllable margin difference?

Sales under budget; costs under budget

Sales exceeding budget; costs under budget

Sales under budget; costs over budget

Sales exceeding budget; costs over budget

5

Based on the following data, what is the amount of working capital?

Accounts payable………………………………………………………..$64,000

Accounts receivable……………………………………………………..114,000

Cash………………………………………………………………………. 70,000

Intangible assets…………………………………………………………100,000

Inventory…………………………………………………………………. 138,000

Long-term investments…………………………………………………..160,000

Long-term liabilities……………………………… ………………………200,000

Short-term investments……………………………………………………80,000

Notes payable (short-term)………………………………………………..56,000

Property, plant, and equipment………………………………………..1,340,000

Prepaid insurance…………………………………………………………….2,000

$370,000

$332,000

$326,000

$284,000

6

Miller Manufacturing’s degree of operating leverage is 1.5. Warren Corporation’s degree of operating leverage is 3. Warren’s earnings would go up (or down) by ________ as much as Miller’s with an equal increase (or decrease) in sales.

2 times

4.5 times

1.5 times

1/2 times

7

What is the primary difference between a static budget and a flexible budget?

The static budget contains only fixed costs, while the flexible budget contains only variable costs.

The static budget is prepared only for units produced, while a flexible budget reflects the number of units sold.

The static budget is constructed using input from only upper level management, while a flexible budget obtains input from all levels of management.

The static budget is prepared for a single level of activity, while a flexible budget is adjusted for different activity levels.

8

Ben Gordon, Inc. manufactures 2 products, wheels and seats. The company has estimated its overhead in the assembling department to be $660,000. The company produces 300,000 wheels and 600,000 seats each year. Each wheel uses 2 parts, and each seat uses 3 parts. How much of the assembly overhead should be allocated to wheels?

$165,000

$220,000

$264,000

$282,856

9

Financial and managerial accounting are similar in that both:

produce general-purpose reports.

deal with the economic events of an enterprise.

have reports that are prepared quarterly and annually.

have the same primary users.

10

It costs Garner Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 3,000 scales at $15 each. Garner would incur special shipping costs of $1 per scale if the order were accepted. Garner has sufficient unused capacity to produce the 3,000 scales. If the special order is accepted, what will be the effect on net income?

$6,000 decrease

$9,000 decrease

$6,000 increase

$45,000 increase

11

Which one of the following is an example of a period cost?

A manager’s salary for work that is done in the corporate head office.

A box cost associated with computers.

A change in benefits for the union workers who work in the New York plant of a Fortune 1000 manufacturer.

Workers’ compensation insurance on factory workers’ wages allocated to the factory.

12

The Mac Company has four plants nationwide that cost $350 million. The current fair value of the plants is $300 million. The plants will be reported as assets at:

$300 million.

$350 million.

$600 million.

$700 million.

13

Are advanced receipts from customers treated as revenue at the time of receipt? Why or why not?

Yes, the intent of the company is to perform the work and the customer is confident that the services will be completed.

No, the amount of revenue cannot be adequately determined until the company completes the work.

Yes, they are treated as revenue at the time of receipt because the company has access to the cash.

No, revenue cannot be recognized until the work is performed.

14

Which statement is correct?

The cash basis of accounting is objective because no one can be certain of the amount of revenue until the cash is received.

As long as management is ethical, there are no problems with using the cash basis of accounting.

As long as a company consistently uses the cash basis of accounting, generally accepted accounting principles allow its use.

The use of the cash basis of accounting violates both the revenue recognition and expense recognition principles.

15

If a plant is operating at full capacity and receives a one-time opportunity to accept an order at a special price below its usual price, then:

the order will likely be accepted.

only variable costs are relevant.

the order will likely be rejected.

fixed costs are not relevant.

16

Kimble Company applies overhead on the basis of machine hours. Given the following data, compute overhead applied and the under- or overapplication of overhead for the period:

Estimated annual overhead cost $1,600,000

Actual annual overhead cost $1,575,000

Estimated machine hours 400,000

Actual machine hours 390,000

$1,560,000 applied and $15,000 underapplied

$1,560,000 applied and $15,000 overapplied

$1,600,000 applied and $15,000 overapplied

$1,575,000 applied and neither under- nor overapplied

17

Scorpion Production Company planned to use 1 yard of plastic per unit budgeted at $81 a yard. However, the plastic actually cost $80 per yard. The company actually made 3,900 units, although it had planned to make only 3,300 units. Total yards used for production were 3,960. How much is the total materials variance?

$3,960 F

$48,600 U

$900 U

$4,860 U

18

Which of the following statements concerning users of accounting information is incorrect?

Present creditors are considered external users.

Taxing authorities are considered external users.

Regulatory authorities are considered internal users.

Management is considered an internal user.

19

Top management notices a variation from budget and an investigation of the difference reveals that the department manager could not be expected to have controlled the variation. Which of the following statements is applicable?

Department managers should be credited for favorable variances even if they are beyond their control.

Department managers should be held accountable for all variances from budgets for their departments.

Department managers’ performances should not be evaluated based on actual results to budgeted results.

Department managers should only be held accountable for controllable variances for their departments.

20

Danner Corporation reported net sales of $650,000, $720,000, and $780,000 in the years 2016, 2017, and 2018, respectively. If 2016 is the base year, what percentage do 2018 sales represent of the base?

120%

83%

20%

108%

21

La More Company had the following transactions during 2016:

Sales of $9,000 on account

Collected $4,000 for services to be performed in 2017

Paid $3,750 cash in salaries for 2016

Purchased airline tickets for $500 in December for a trip to take place in 2017

What is La More’s 2016 net income using accrual accounting?

$9,250

$9,750

$5,250

$5,750

22

If there are no units in process at the beginning of the period, then:

the units started into production will equal the number of units transferred out.

the company must be using a job order cost system.

the units to be accounted for will equal the units transferred out and the units in process at the end of the period.

only one computation of equivalent units of production will be necessary.

23

Which of the following is not an underlying assumption of CVP analysis?

Sales mix is constant.

Beginning inventory is larger than ending inventory.

Cost classifications are reasonably accurate.

Changes in activity are the only factors that affect costs.

24.

In performing a vertical analysis, the base for sales revenues on the income statement is:

net sales.

cost of goods available for sale.

sales revenue.

net income.

25

Differences between a job order cost system and a process cost system include all of the following except the:

unit cost computations.

flow of costs.

documents used to track costs.

point at which costs are totaled.

26

Henson Company began the year with retained earnings of $380,000. During the year, the company recorded revenues of $500,000, expenses of $380,000, and paid dividends of $40,000. What was Henson’s retained earnings at the end of the year?

$460,000

$540,000

$840,000

$500,000

27

At September 1, 2017, Baxter Inc. reported Retained Earnings of $423,000. During the month, Baxter generated revenues of $60,000, incurred expenses of $36,000, purchased equipment for $15,000 and paid dividends of $6,000. What is the balance in Retained Earnings at September 30, 2017?

$24,000 credit

$423,000 debit

$426,000 credit

$441,000 credit

28

An activity-based overhead rate is computed as follows:

estimated overhead divided by actual use of cost drivers.

actual overhead divided by estimated use of cost drivers.

estimated overhead divided by estimated use of cost drivers.

actual overhead divided by actual use of cost drivers.

29.

Which is the last step in developing the master budget?

Preparing the cash budget

Preparing the cost of goods manufactured budget

Preparing the budgeted balance sheet

Preparing the budgeted income statement

30

The entry to record the acquisition of raw materials on account is:

Manufacturing Overhead Raw Materials Inventory Accounts Payable

Work in Process Inventory Accounts Payable

Raw Materials Inventory Accounts Payable

Accounts Payable Raw Materials Inventory

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 1 Financial Statement Differentiation Paper (New Syllabus)

Financial Statement Differentiation Instructions:

Write a paper between 700 and 1,000 words discussing the four different types of financial statement. Explain the information provided by each financial statement and include specific examples.

Incorporate your responses to the following questions. Which financial statement or statement would be of most interest to investors, creditors and management. Why?

Format your paper consistent with APA guidelines and submit your paper and plagiarism review file via the assignment files tab.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 1 Individual Assignment Financial Statements (2 Papers) (New Syllabus)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 1 Individual Assignment Financial Statements (Boeing)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 1 Individual Assignment Financial Statements (Walt Disney)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 2 Assignment Accounting Methods (Bizcon, 2 Papers)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 2 Individual Assignment Accounting & The Regulatory Environment Presentation

| In the wake of the accounting and finance scandals of the early 2000s, the regulatory environment for businesses changed dramatically to create more accountability and transparency. Agencies like the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) play a greater role in enforcing and auditing companies for compliance to regulations such as the Sarbanes-Oxley Act of 2002. Select an accounting regulatory or standards agency (e.g. PCAOB, IASB, etc.) Select a public company that you either currently work for, have worked for in the past, or one with which you are familiar. Create a presentation with an analysis of the regulatory environment:

Format your assignment consistent with APA guidelines. Click the Assignment Files tab to submit your assignment. |

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 2 Individual Assignment Accounting The Regulatory Environment (2 Papers)

This Tutorial contains 2 Papers of this Assignment

In the wake of the accounting and finance scandals of the early 2000s, the regulatory environment for businesses changed dramatically to create more accountability and transparency. Agencies like the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) play a greater role in enforcing and auditing companies for compliance to regulations such as the Sarbanes-Oxley Act of 2002.

Select an accounting regulatory or standards agency (e.g. PCAOB, IASB, etc.)

Select a public company that you either currently work for, have worked for in the past, or one with which you are familiar.

Create a 1,050-word analysis of the regulatory environment:

- Identify one or more regulations that would apply to your selected company.

- Discuss the ways that compliance with the regulations is beneficial to the company, industry, and consumers.

- Examine how the agency you selected and your selected company work together.

- Explain the role of ethics in the regulatory environment.

- Discuss the ways in which the regulatory environment would directly affect your role in the company in either your current role or your desired career with the organization.

Format your assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 2 Small business analysis (May 2020, New Syllabus)

You are interested in establishing a small business. Write a paper between 1,000 and 1,500 words discussing your small-business idea. Include the following:

1. Discuss your business and the product or service your small business provides.

2. Identify which accounting method (i.e. cash versus accrual) you plan to use for your business. Why did you select this choice?

3. List six business transactions you expect to incur with your company. State which accounts (from your chart of accounts) are impacted.

4. Discuss how each business transaction (see point 3) impacts your income statement, balance sheet and statement of cash flow.

5. Select one organization type (sole proprietorship, partnership, C-corporation, and S-corporation) for your company and explain why you selected this option.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 2 Small Business Analysis (New Syllabus)

Small Business Analysis Instructions:

You are interested in establishing a small business and you must decide which of the four forms of business organization would best suit your unique product or service. Consider legal, tax, accounting, and other implications when selecting from the four business types. Write a paper between 1,000 and 1,500 words discussing your small-business idea. Include the following:

1. The advantages and dis advantages of the four different forms of business organization, Which include sole proprietorship, partnership,C-corporation, and S-corporation s.

2. Identify which accounting method (i.e. cash versus accrual) you plan to use for your business. Why did you select this choice?

3. An explanation of the product or service your small business provides.

4. State three business transactions you expect to incur to with your company. Discuss how the transactions impact your income statement, balance sheet and statement of cash flow.

5. Select an organization type for your company and explain why you selected this option.

Format your paper consistent with APA guidelines and submit your paper and plagiarism review file via the assignment files tab.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Assignment Ratio Analysis (P Jason, New Syllabus)

Purpose of Assignment

This week’s focus is on the preparation of financial reports for internal users, such as managers. This case study applies the concepts of managerial accounting, through comparative and ratio analysis, and requires students to identify financial data needed by managers for decision making.

About Your Signature Assignment

This signature assignment is designed to align with specific program student learning outcome(s) in your program. Program Student Learning Outcomes are broad statements that describe what students should know and be able to do upon completion of their degree. The signature assignments may be graded with an automated rubric that allows the University to collect data that can be aggregated across a location or college/school and used for program improvements.

Assignment Steps

Resources: Generally Accepted Accounting Principles (GAAP), U.S. Securities and Exchange Committee (SEC)

Tutorial help on Excel® and Word functions can be found on the Microsoft® Office website. There are also additional tutorials via the web offering support for Office products.

Scenario: You are a loan officer for White Sands Bank of Taos. Paul Jason, president of P. Jason Corporation, has just left your office. He is interested in an 8-year loan to expand the company’s operations. The borrowed funds would be used to purchase new equipment. As evidence of the company’s debt-worthiness, Jason provided you with the following facts:

| 2017 | 2016 | |

| Current Ratio | 3.1 | 2.1 |

| Asset Turnover | 2.8 | 2.2 |

| Net Income | Up 32% | Down 8% |

| Earnings per Share | $3.30 | $2.50 |

Jason is a very insistent (some would say pushy) man. When you told him you would need additional information before making your decision, he acted offended and said, “What more could you possibly want to know?” You responded you would , at minimum, need complete, audited financial statements.

Develop a minimum 700-word examination of the financial statements and include the following:

· Explain why you would want the financial statements to be audited.

· Discuss the implications of the ratios provided for the lending decision you are to make. That is, does the information paint a favorable picture? Are these ratios relevant to the decision? State why or why not.

· Evaluate trends in the performance of White Sands Bank. Identify each performance measure as favorable or unfavorable and explain the significance of each.

· List three other ratios you would want to calculate for White Sands Bank of Taos, and in your own words explain in detail why you would use each.

· As the loan officer, what else would you do to gain a better understanding of Paul Jason’s, and the Corporation’s financial picture and why?

· Based on your analysis of White Sands Bank, will you recommend approval for the requested loan? Provide specific details to support your decision.

Format the assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Business Plan Develop a business plan and financial metrics Tootsie Roll

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

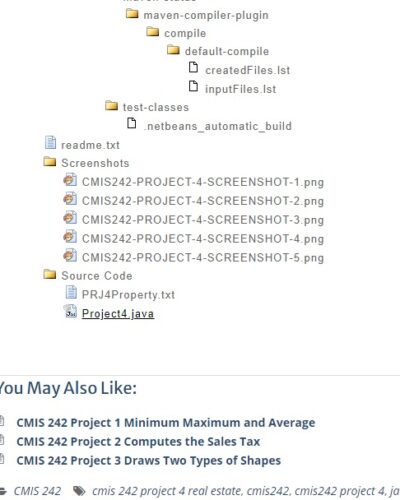

ACC 561 Week 3 Ratio Analysis (BRIDGFORD) (May 2020 Syllabus)

ACC/561: Accounting

Top of Form

Financial Analysis:

1. Open the Excel spreadsheet provided. Prepare a vertical analysis of Bridgford’s income statement. Enter the percentages in columns C, E, G, I and K. For additional information regarding vertical analysis, please review the following.

2. Prepare a projected income statement assuming sales increase by 3% in 2020 and 6% in 2021.

- Average your vertical analysis percentages for each income statement account and enter the results in column L, rows 5 – 11. Example: Add columns C, E, G, I and K and divide by 5. (64.07+60.58+63.17+67.57+67.34)/5=64.55%. Column L, row 5 = 64.55%.

- Enter your projected sales number in columns M & N, row 4.

- Columns M and N: Multiply projected sales by the average percentage for each income statement account.

3. Ratio Computations. Use Excel formulas to calculate financial ratios listed with the income statement and balance sheet tabs. Calculate ratios for seven years (i.e. 2015-2021). Do not prepare ratios that require data from the 2020 and 2021 balance sheet. In this case, “N/A” is entered in the appropriate cell. For additional information regarding ratios, please review the following.

Note: If there is a discrepancy between the formula used in our text versus the formula included with the above link, use the formula incorporated with the above link.

4. Loan: The written section of the project includes a loan discussion and CFO questions and explanations. Use the following resources to complete your analysis.

Corporate Annual and Earnings Report

5. Chief Financial Officer Questions: Using the results of your spreadsheet, what questions would you ask the CFO of Bridgford Foods? Explain.

Bottom of Form

Reply

Week 3 Ratio Analysis and 10-K Review

Top of Form

Bottom of Form

Assignment Content

Top of Form

Prepare an analysis of the assigned company (600 – 2,000 words) in order to secure a loan for the company. The loan will increase the company’s total liabilities by 3%. The assigned company is posted to the conversation section in the upper right corner. The contents of the plan should include the following:

1. Discuss the loan amount and how you plan to use the loan proceeds.

2. Use the Excel spreadsheet provided and complete the following.

- a. Prepare a five year vertical analysis of the company’s income statement.

- b. Prepare a projected income statement for 2020 and 2021 assuming sales increase by 3% and 6%.

- c. Compute the ratios listed with the income statement.

- d. Compute the ratios listed with the balance sheet.

3. Using the results of your spreadsheet, what questions would you ask the CFO of the company? Explain.

The assigned company, spreadsheet, detailed instructions, and guidance are provided during week three. To review this information select the conversation icon in the upper right corner.

Format your paper consistent with APA guidelines. Deliverables: Paper (MS Word) and Excel Spreadsheet. Review your Originality Report generated from SafeAssign. A new originality report is created with each attempt. Your last attempt is used for grading.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Team Assignment Financial Statement Analysis

| Learning Team members perform the calculations using the financial statements from their individual companies. Part I Complete the following:

Part II Develop a presentation with an evaluation of the selected companies in which the team does the following:

Format the assignment consistent with APA guidelines. Click the Assignment Files tab to submit your assignment. |

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Team Assignment Financial Statement Analysis (2 Set)

This Tutorial contains 2 Papers of this Assignment

Learning Team members will refer back to their Week 1 Individual Assignment and perform the calculations using the financial statements from their individual companies.

Part I

Complete the following:

- Perform at least one profitability ratio to measure the income and operating success of your selected company.

- Perform at least one liquidity ratio to measure the ability of the company to pay short-term debt and meet unexpected needs.

- Perform at least one solvency ratio to measure the ability of the company to survive in the long-term.

- Review all of the calculations of the different companies as a team. Compare the profitability, liquidity, and solvency ratios.

- Complete a spreadsheet that presents the profitability, liquidity, and solvency ratios comparatively for all of the companies.

- Highlight the company that has the best numbers for each ratio.

Part II

Develop a 700-word evaluation of the selected companies in which the team does the following:

- Evaluate the financial opportunity presented by the companies. If the team was going to lend money to one of the companies reviewed, which one would it be? Defend the team’s decision.

- Evaluate the investment opportunity presented by the companies. If the team could invest $100,000 in one of the companies, which would the team select? Provide the rationale.

- Evaluate the employment opportunity presented by the companies. If the team members could work for any of the companies, which company would the team select? Defend the team’s decision.

Format the assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Team Assignment Tootsie Roll Industries Inc. Loan Package

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 3 Team Financial Statement Analysis and Decision Making Activity

Week Three Learning Team

Purpose of Assignment

The activity requires students to perform research and analysis on competing companies and the potential implications of international standards. This real-world analysis is key to understanding how a company’s profitability, liquidity, and solvency can be useful for all users. Students also learn to analyze financial statements and use managerial tools to make decisions from an investor’s and creditor’s standpoint.

Assignment Steps

Resources: U.S. Securities and Exchange Commission (SEC), websites such as Annual Reports (AnnualReports.com)

Tutorial help on Excel® and Word functions can be found on the Microsoft® Office website. There are also additional tutorials via the web offering support for Office products.

Select two competing companies, one of which must be an international company, and locate annual reports for these two companies on the Internet.

Research the two companies on the Internet and download the Income Statement, Statement of Shareholders’ Equity, Balance Sheet, and Statement of Cash Flows.

Develop a minimum 525-word examination of the financial statements and include the following:

· Make a 5-year trend analysis for each company, using 2011 as the base year, of:

o Net sales.

o Net income. Discuss the significance of the trend results.

· Compute for 2015 and 2014 the:

o Debt to assets ratio.

o Times interest earned. How would you evaluate each company’s solvency?

· Compute for 2015 and 2014 the:

o Profit margin.

o Asset turnover.

o Return on assets.

o Return on common stockholders’ equity. How would you evaluate each company’s profitability?

· Evaluate the financial opportunity presented by the companies. If you were a creditor, which company would you be more likely to lend money to? Defend your decision.

· Which company would you recommend as an investment? Discuss the items that were considered in your decision.

· Research global implications for the international company selected. How might changing environmental factors affect organizational choices?

· Consider the ethical climate (internal or external) of your chosen companies. Describe the ethical issues and impact on the stakeholders. What has been/is being done to resolve these issues? Do you agree with these methods for resolution? If not, what might you do differently?

Show your work in Microsoft® Word or Excel®.

Complete calculations/computations using Microsoft® Word or Excel®.

Include the four financial statements along with your assignment.

Format your assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment.

Note: Grades are awarded based upon individual contributions to the Learning Team assignment. Each Learning Team member receives a grade based upon his/her contributions to the team assignment. Not all students may receive the same grade for the team assignment.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 4 Assignment Production Cost (Davis Skaros, New Syllabus)

Week Four

Purpose of Assignment

The materials covered this week distinguish between the different costing methods and provides needed tools for decision making. This case study focuses on determining equivalent units in a production business setting.

Assignment Steps

Resources: Generally Accepted Accounting Principles (GAAP), U.S. Securities and Exchange Committee (SEC)

Tutorial help on Excel® and Word functions can be found on the Microsoft® Office website. There are also additional tutorials via the web offering support for Office products.

Scenario: Davis Skaros has recently been promoted to production manager. He has just started to receive various managerial reports, including the production cost report you prepared. It showed his department had 2,000 equivalent units in ending inventory. His department has had a history of not keeping enough inventory on hand to meet demand. He has come to you, very angry, and wants to know why you credited him with only 2,000 units when he knows he had at least twice that many on hand.

Prepare a maximum 700-word informal memo and explain to Mr. Skaros why his production cost report showed only 2,000 equivalent units in ending inventory. Using a professional tone, explain to him clearly why your report is accurate.

![]()

Format the assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 4 Business Analysis Super bakery (May 2020 Syllabus)

Read the case study provided and write a paper between 1,000 and 1,700 words addressing the following questions.

1. You are a recent MBA graduate and were hired by the company as a business consultant. Your objective is to identify areas for improvement. Present three business recommendations to management and state how this will impact the company’s financial statements.

2. Why did company management think it was necessary to install an ABC system? Do you agree with their reasoning? Explain your answer.

3. Evaluate and recommend changes to the organization’s cost drivers. State how this influences cost accounting results and business decision capabilities.

4. Is job order or process costing a viable option for the company. Why or why not?

Format your paper consistent with APA guidelines. Deliverable: Paper (MS Word).

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 4 Costing Methods Super Bakery

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 4 Team Assignment Cost Accounting Systems (2 PPT)

| This Tutorial contains 2 Presentation of this Assignment Consider the places of employment of the team members or businesses with which the team is familiar and the industries in which they operate. Create a 12-slide presentation, including detailed speaker notes that act as the script of the presentation or a voiceover, of an analysis of cost accounting systems. Include the following in the presentation:

Format the assignment consistent with APA guidelines. |

Click the Assignment Files tab to submit your assignment

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 4 WileyPLUS Assignment Paper Exercise 17-2

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Assignment Case Study CVP, Break-even, margin of safety (Mary Willis, New Syllabus)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Cost analysis and Business Planning (Kosama) (May 2020 Syllabus)

Write a paper between 700 and 1,000 words addressing the following:

Part 1, Sections 1-2: Provide calculations and a solution for total variable costs, break even in sales volume (number of members), break even in sales (in dollars), and margin of safety.

Part 1, Section 3: Respond to the questions included with the case study.

Part 1, Section 4: Assume you decide to invest in the franchise. Provide a description and estimates in dollars for monthly sales, variable and fixed expenses. Explain how you determined each number and provide a written list of assumptions.

A case study and instructions are provided during week five.

Case Study: In addition to regular gyms, nontraditional workout concepts and centers such as Kosama are increasing in popularity. Kosama is a franchise opportunity that offers members the opportunity to improve their health and fitness level. To learn more about the company visit kosama.com.

Part 1, Section 1: Assume the following revenue and cost break-down.

Revenue: Monthly membership fee = $28.

Costs:

-General fixed operating expenses = $3,975 per month.

-Equipment Lease = $410 per month.

-Towel service = $.50 per member based on volume.

-Mixed costs are equal to $275 per/month (fixed) plus $1.10 per membership sale (variable).

-Total variable costs are not known.

-Estimated number of members required to break even is between 255 and 275 members per month.

Using the information provided estimate the amount of variable costs. When performing your analysis, assume that the only fixed costs are the estimated monthly operating expenses, equipment lease and the fixed part of mixed costs. Show your work and all calculations.

Part 1, Section 2: Using the information from section 1. What would monthly sales in members and dollars have to be to achieve a target net income of $14,500 for the month? What is the margin of safety in dollars? Show your work and all calculations.

Part 1, Section 3: Discuss how cost structure, relevant range, margin of safety, cost behaviors, and CVP apply to an investment in the franchise. How do you plan to use this in order to manage the business and plan for profitability? What type of internal accounting reports would you prepare? Why?

Part 1, Section 4: Assume you decide to invest in the franchise. Provide a description and estimates in dollars for sales, variable and fixed expenses. Explain how you determined each number and provide a written list of assumptions.

The following is additional explanations and resources.

Part 1, Section 1: Use the following formula in order to determine total variable costs.

Sales – Variable Costs – Fixed Costs = Net Income.

Add the problem data to the formula and solve for the missing piece of the equation (i.e. variable costs).

1. Membership sales is equal to sales volume times the price per member.

2. Total variable costs is not known. Enter X in the above formula.

3. Total fixed costs are provided with the problem. Enter fixed costs in the above formula.

4. Net income at the break even is equal to zero. Enter 0 in the above formula for net income.

5. Solve the equation. X = total variable costs.

The above formula determines total variable costs at the break-even.

Part 1, Section 2: Use the solution from part 1, section 1 (i.e. variable costs) in order to calculate the contribution margin (i.e. sales – variable costs) on a per unit (member) basis. In addition to fixed costs, add targeted net income equal to $14,500.

Contribution Margin:

Sales: membership sales times the price per member

Minus Variable Costs: See solution in part 1, section 1.

Equals: Contribution Margin in dollars

Contribution Margin in dollars / number of memberships = contribution margin per member.

The next step is to determine what would monthly sales in members and dollars have to be to achieve a target net income equal to $14,500 for the month? Utilize the CVP formula (fixed costs / contribution margin per member) to finalize the problem. Compute the margin of safety.

Resource – Enhance learning & understanding: For additional guidance regarding cost volume profit analysis and related cost concepts please review the following.

Franchise Agreement: As you review and analyze the franchise opportunity it is important to develop a thorough understanding of the franchise agreement prior to investing. The following is an article that explains the basic fundamentals of an agreement.

Part 1 Section 4: You need to estimate/project sales, variable, and fixed expenses for your business. The first step is to determine a physical location for your franchise (i.e. city & state). Once this is identified, begin researching what the average monthly fee is for comparable fitness clubs in your area. The monthly fee per customer will help you determine sales revenue. The next step is to estimate your expenses. Do you plan to buy a building or sign a lease? Real estate is typically leased based on square footage. How many square feet does your business require and what is the cost per square foot based on the location of your business? In addition to the lease expense, do you expect to incur additional fixed expenses such as the purchase of fitness equipment? Finally, you need to determine all of your variable expenses. This could include hourly wages, sales commissions, utilities, etc.

Assumptions: Explain how you developed estimates for sales revenue and business expenses and list any assumptions.

Example:

1. Explain how you developed your monthly fee and volume estimates.

2. Discuss why you decided to rent or buy a building and the related costs such as rent per square foot based on, in part, the location of your business.

The key is to present the data in a professional manner so the end user (business owner, etc.) can review the numbers, understand it, and modify it in the future with little effort. If you use Excel add formulas so you can modify the data to account for changes in activity. This will help you manage your investment in the franchise. Example: What if sales volume is more or less than your original estimate? In this case you could change sale volume (number of members) and sales revenue and variable expenses automatically change based on formulas in the spreadsheet.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 CVP and Break-Even Analysis (snapfitness)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Individual Assignment Costing Methods Paper (Exercise 19-17) (2 Papers)

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Individual/TeamWileyPLUS Assignment Paper Exercise 18-1

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Team Cost Behavior Analysis (2 PPT)

This Tutorial contains 2 PPT of this Assignment

Week Five Learning Team Assignment

Purpose of Assignment

The case study focuses on break-even, margin of safety, and incremental analysis and allows students to experience working through a business scenario to apply these tools in managerial decision making. Students are required to make decisions and provide solutions based on their evaluation of financial data.

Assignment Steps

Resources: Generally Accepted Accounting Principles (GAAP), U.S. Securities and Exchange Committee (SEC)

Tutorial help on Excel® and Word functions can be found on the Microsoft® Office website. There are also additional tutorials via the web offering support for Office products.

Scenario: Shelley Jones has just been elected as president of the Circular Club of Auburn, Kansas, and she has been asked to suggest a new fundraising activity for the club. After a considerable amount of research, Shelley proposed the Circular Club sponsor a professional rodeo. In her presentation to the club, Shelley recommends the fundraiser become an annual activity with the following goals:

· Continue to grow each year

· Give back to the community

· Provide the club a presence in the community

Shelley’s goal in the first year is to have an activity that would become an “annual community event” and would break even the first year and raise $5,000 the following year. In addition, based on the experience of other communities, Shelley believed a rodeo could grow in popularity so the club would eventually earn an average of $20,000 annually.

A rodeo committee was formed. Shelley contacted the world’s oldest and largest rodeo-sanctioning agency to apply to sponsor a professional rodeo. The sanctioning agency requires a rodeo to consist of the following five events: Bareback Riding, Bronco Riding, Steer Wrestling, Bull Riding, and Calf Roping, Team Roping and Women’s Barrels. Prize money in the amount of $3,000 would be paid to winners in each of the seven events. Members of the rodeo committee contracted with RJ Cattle Company, a livestock contractor on the rodeo circuit, to provide bucking stock, fencing, and chutes. Realizing costs associated with the rodeo were tremendous and ticket sales would probably not be sufficient to cover the costs, the rodeo committee sent letters to local businesses soliciting contributions in exchange for various sponsorships. Exhibiting Sponsorships are $1,000 to exhibit products or services, while Major Sponsorships are $600, and Chute Sponsorships are $500 to have the name of the sponsor’s business on one of the six bucking chutes. For a contribution of $100, individual sponsors will be included in a Friends of Rodeo list found in the rodeo programs.

A local youth group will be contacted to provide concessions to the public and divide the profits with the Circular Club. The Auburn Circular Club Pro Rodeo Roundup will be held on June 1, 2, and 3. The cost of an adult ticket is set at $8 in advance or $10 at the gate; the cost of a ticket for a child 12 or younger is set at $6 in advance or $8 at the gate. Tickets are not date-specific. Rather, one ticket will admit an individual to one performance of his or her choice– Friday, Saturday, or Sunday. The rodeo committee is able to secure a location through the county supervisors’ board at a nominal cost to the Circular Club. The arrangement allows for the use of the county fair grounds and arena for a one-week period. Several months prior to the rodeo, members of the rodeo committee were notified the bleachers at the arena would hold 2,500 patrons. On Saturday night, paid attendance was 1,663, but all seats were filled due to poor gate controls. Attendance was 898 Friday and 769 on Sunday.

The following revenue and expense figures relate to the first year of the rodeo.

Receipts

Contributions from sponsors $22,000

Receipts from ticket sales $28,971

Share of concession profits $1,513

Sale of programs $600

Total receipts $53,084

Expenses

Livestock contractor $26,000

Prize money $21,000

Contestant hospitality $3,341*

Sponsor signs for arena $1,900

Insurance $1,800

Ticket printing $1,050

Sanctioning fees $925

Entertainment $859

Judging fees $750

Port-a-potties $716

Rent $600

Hay for horses $538

Programs $500

Western hats to first 500 children $450

Hotel rooms for stock contractor $325

Utilities $300

Sand for arena $251

Miscellaneous fixed costs $105

Total expenses $61,410

Net loss $ (8,326)

*The club contracted with a local caterer to provide a tent and food for the contestants. The cost of the food was contingent on the number of contestants each evening. Information concerning the number of contestants and the costs incurred are as follows:

Contestants Total Cost

Friday 68 $998

Saturday 96 $1,243

Sunday 83 $1,100

$3,341

On Wednesday after the rodeo, members of the rodeo committee met to discuss and critique the rodeo. Jonathan Edmunds, CPA and President of the Circular Club, commented that the club did not lose money. Rather, Jonathan said, “The club made an investment in the rodeo.” The rodeo committee has requested an analysis of the rodeos performance and evaluation of the CPA’s review.

Create a minimum 10-slide presentation, including detailed speaker notes, as the committee’s consultation team and respond to the following:

· What did Jonathan Edmunds mean when he said the club had made an investment in the rodeo? Is his comment consistent with Shelley’s idea that the club should have a fundraiser that would:

o Continue to get better each year.

o Give back to the community.

o Provide the club a presence in the community? Why or why not?

· Shelley, Jonathan, and Adrian Stein, the Fundraising Chairperson, are beginning to make plans for next year’s rodeo. Shelley believes by negotiating with local feed stores, inn- keepers, and other business owners, costs can be cut dramatically. Jonathan agrees. After carefully analyzing costs, Jonathan has estimated the fixed expenses can be pared to approximately $51,000. In addition, Jonathan estimates variable costs are 4% of total gross receipts. After talking with business owners who attended the rodeo, Adrian is confident the funds solicited from sponsors will increase. Adrian is comfortable in budgeting revenue from sponsors at $25,600. The local youth group is unwilling to provide concessions to the audience unless they receive all of the profits. Not having the personnel to staff the concession booth, members of the Circular Club reluctantly agree to let the youth group have 100% of the profits from the concessions. In addition, members of the rodeo committee, recognizing the net income from programs was only $100, decide not to sell rodeo programs next year.

o Compute the break-even point in dollars of ticket sales assuming Adrian and Jonathan are correct in their assumptions.

· Shelley has just learned you are calculating the break-even point in dollars of ticket sales. She is still convinced the Club can make a profit using the assumptions above (second bullet point above).

o Calculate the dollars of ticket sales needed to earn a target profit of $6,000.

o Calculate the dollars of ticket sales needed to earn a target profit of $12,000.

· Are the facilities at the fairgrounds adequate to handle crowds needed to generate ticket revenues calculated above (third bullet point above) to earn a $6,000 profit? Show calculations to support your answers.

· A few members in the Circular Club do not want to continue with the annual rodeo. However, Shelley is insistent the Club must continue to conduct the rodeo as an annual fundraiser. Shelley argues she has spent hundreds of dollars on western boots, hats, and other items of clothing to wear to the rodeo. Are the expenses related to Shelley’s purchases of rodeo clothing relevant costs? Why or why not?

· Rather than hire the local catering company to cater the Contestant Hospitality Tent, members of the Circular Club are considering asking Shady’s Bar-B-Q to cater the event in exchange for a $600 Major Sponsor spot. In addition, The Fun Shop, a local party supply business, will be asked to donate a tent to use for the event. The Fun Shop will also be given a $600 Major Sponsor spot. Several members of the Club are opposed to this consideration, arguing that the two Major Sponsor spots will take away from the money to be earned through other sponsors. Adrian Stein has explained to the members the Major Sponsor signs for the arena cost only $48 each. In addition, there is more than enough room to display two additional sponsor signs. What would you encourage the Club to do concerning the Contestant Hospitality Tent? Would your answer be different if the arena were limited in the number of additional signs that could be displayed? What kind of cost would you consider in this situation that would not be found on a financial statement?

· Assume you are elected chair of the rodeo committee for next year. What steps would you suggest the committee take to make the rodeo profitable?

Show your work in Microsoft® Word or Excel®.

Complete calculations/computations using Microsoft® Word or Excel®.

Format the assignment consistent with APA guidelines.

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 5 Team Assignment Costing Methods Presentation (2 PPT)

This Tutorial contains 2 Presentation of this Assignment

Develop an 8-slide presentation regarding costing methods as related to the scenario in Exercise 19-7, which all team members completed in WileyPLUS. Include the following:

- Recommend a costing method in choosing between variable or absorption costing. Explain the team’s decision.

- Explain the benefits of each of the two methods.

- Determine which method would lead to the best decision when a competitor is submitting a lower bid for your product. Explain your answer.

- Explain how applying costing methods can aid in better managerial decision-making.

Format your assignment consistent with APA guidelines.

Click the Assignment Files tab to submit your assignment

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 6 Assignment Managerial Analysis Assessment (Green Pasture, New Syllabus, 2 Papers)

This Tutorial contains 2 Papers of this Assignment

Week Six Individual Assignment

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 6 Budget Preparation And Variance Analysis (June 2020 Syllabus)

The purpose of this assignment is to evaluate and prepare a budget.

Resources: Excel File. Tutorials and links to Excel help files were provided during week one of our class.

Instructions:

1. Download the Excel file provided. The file is available at the end of week five.

2. Read the instructions tab.

3. Complete the Budget and Variance Analysis tab.

4. Submit the completed Excel file.

1 Prepare a flexible budget using estimated annual unit sales = 3,500. Enter volume in the Budget and Variance Analysis tab, column H, row 4. Enter all other data and calculations in the appropriate cells (column H).

2 The company adopted the accrual method of accounting in 2019. The cumulative affect of change in accounting principle, net of tax, equal to $35K was recorded with their GAAP based financial statements.

3 The company purchased equipment equal to $20,000. Terms: 5 year loan with an interest rate equal to 4.8% and $5,000 cash down payment.

Depreciation: Straight-line method, 5 year useful life, no residual value.

4 Increase the average animal fee by 1.75% for the first five months and 2.85% for the remaining seven months of the year.

5 The owner’s sister is stationed in Europe with the military and wants to open another location or help with animal training for the military after she transitions to civilian life. Estimated start-up costs are $25K.

She doesn’t know if this will occur nor is the owner definitively planning for this option.

6 The owner is evaluating regional competitors for a potential business acquisition. Approximately $5,000 will be invested with a third party search firm in 2020.

7 Excess cash was invested in an S&P 500 Index fund with estimated annual capital gain and dividend income equal to $11,000.

8 The company sold grooming equipment for a $500 dollar gain. However, the equipment is not expected to be delivered to the buyer nor will the owner receive payment.

9 The company is diversifying into animal training and recorded unearned income in 2019 equal to $175,000 for cash advances from the U.S. government. The company expects to train several animals for special operation forces in 2020.

Earned income is estimated to be $125,000.

10 Increase the variable cost per unit (animal) by 2.75%. This applies to all variable cost categories (excluding advertising, bedding, and specialty food).

11 The driver for bedding and specialty food is the number of non-traditional animals. The company expect 320 animals per year at an average cost of $1.75 per animal for bedding and $1.35 per animal for specialty food.

12 The company plans to relocate the business. This may increase rent by $750.

13 The company uses a dated advertising program including the yellow pages and billboard signs. The company plans to reduce costs and increase effectiveness by investing in an online campaign.

The cost structure changes to a mixed cost and includes $1200 fixed plus variable costs. The variable cost is equal to .05 per online view plus $4.00 for appointments scheduled online.

The company expects 1,550 views and 225 scheduled appointments.

14 Use the skills you learned from the week five project. Compute the break even point in units and dollars. Compute the margin of safety. Enter the information in the Budget and Variance Analysis tab, rows 50-56.

15 Use formulas to compute variances and explain why the variances are positive or negative. Enter formulas in the Budget and Variance Analysis tab column J. Write your explanations in column L.

Download the Excel file provided. Your responsibility is to calculate prior year actual results and prepare a flexible budget. Use prior year data to complete the 2018 variable costing income statement. The flexible budget includes several changes to the data. The changes are listed in the Excel file / Instructions Tab.

Excel: In order to minimize errors, improve accuracy, and increase efficiency use formulas in all cells. If you need assistance with Excel review the week one questions thread. Included therein are three options to help you advance your Excel skills. Two links at the bottom are titled “Formula Overview” and “Excel – Basic Math”. The third option is Excel Essential Training (week one learning activities). The tutorials will help you with, in part, formulas and spreadsheet format.

Video: In order to gain experience and insight please review the following video. It is a simple presentation and will help everyone develop a basic understanding of flexible budgets. The video was created by a third party. There are additional videos included with the Bing search as well.

Flexible Budget Guidance: For additional information regarding flexible budgets please review the following.

Based on the example, fixed expenses do not change with volume. Contrary, variable expenses change with volume. With respect to the case study the same principles apply. The only difference is that our variable expenses will change based on sales volume instead of machine hours.

Example:

Sales Volume 2,640

Feed cost per animal 3.13

Total feed cost = 3,000*3.23=8,263

Advertisement, Bedding and Specialty Food Expense: Advertisement is a fixed expense at the 2,640 volume level (column F). As a result, column F, row 17 is equal to -0-. However, the expense is considered a mixed cost (fixed and variable) with the flexible budget (column H). Bedding and specialty food does not apply to the prior year income statement (column F). As a result, column F, rows 18 and 19 is equal to -0-. For further clarification my suggestion is to read the instructions tab.

Variance and Variance Explanation: A variance is the difference between two numbers. From a budget perspective we typically compare actual business results to our budget. Material deviations are analyzed to help us plan, in part, cash flow, revenue projections, expense levels, and to make informed business decisions.

Calculate the variance for all items listed on the spreadsheet (i.e. sales, all variable and fixed expenses, contribution margin, net income, and the break even computation).

Column J: Enter the difference between actual results and the budget.

Column L: Explain the difference

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 6 Budget Preparation And Variance Analysis (May 2020 Syllabus)

The purpose of this assignment is to evaluate and prepare a budget.

Resources: Excel File. Tutorials and links to Excel help files were provided during week one of our class.

Instructions:

1. Download the Excel file provided. The file is available at the end of week five.

2. Read the instructions tab.

3. Complete the Budget and Variance Analysis tab.

4. Submit the completed Excel file.

Download the Excel file provided. Your responsibility is to calculate prior year actual results and prepare a flexible budget. Use prior year data to complete the 2018 variable costing income statement. The flexible budget includes several changes to the data. The changes are listed in the Excel file / Instructions Tab.

Excel: In order to minimize errors, improve accuracy, and increase efficiency use formulas in all cells. If you need assistance with Excel review the week one questions thread. Included therein are three options to help you advance your Excel skills. Two links at the bottom are titled “Formula Overview” and “Excel – Basic Math”. The third option is Excel Essential Training (week one learning activities). The tutorials will help you with, in part, formulas and spreadsheet format.

Video: In order to gain experience and insight please review the following video. It is a simple presentation and will help everyone develop a basic understanding of flexible budgets. The video was created by a third party. There are additional videos included with the Bing search as well.

Flexible Budget Guidance: For additional information regarding flexible budgets please review the following.

Based on the example, fixed expenses do not change with volume. Contrary, variable expenses change with volume. With respect to the case study the same principles apply. The only difference is that our variable expenses will change based on sales volume instead of machine hours.

Example:

Sales Volume 2,640

Feed cost per animal 3.13

Total feed cost = 3,000*3.23=8,263

Advertisement, Bedding and Specialty Food Expense: Advertisement is a fixed expense at the 2,640 volume level (column F). As a result, column F, row 17 is equal to -0-. However, the expense is considered a mixed cost (fixed and variable) with the flexible budget (column H). Bedding and specialty food does not apply to the prior year income statement (column F). As a result, column F, rows 18 and 19 is equal to -0-. For further clarification my suggestion is to read the instructions tab.

Variance and Variance Explanation: A variance is the difference between two numbers. From a budget perspective we typically compare actual business results to our budget. Material deviations are analyzed to help us plan, in part, cash flow, revenue projections, expense levels, and to make informed business decisions.

Calculate the variance for all items listed on the spreadsheet (i.e. sales, all variable and fixed expenses, contribution margin, net income, and the break even computation).

Column J: Enter the difference between actual results and the budget.

Column L: Explain the difference

ACC 561 ACC561 ACC/561 ENTIRE COURSE HELP – UNIVERSITY OF PHOENIX

ACC 561 Week 6 Budgets and Decisions making