-45%

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

$149.99$275.00

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

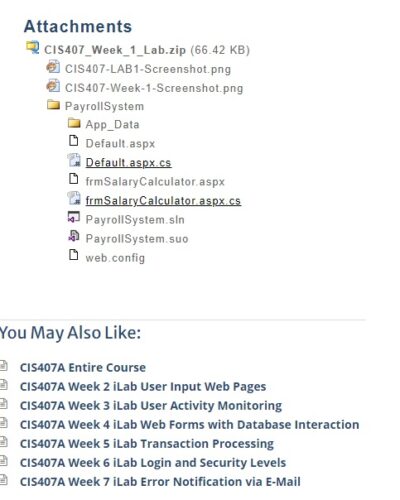

ACC 418 Module 1 Assignment 3 Calculating Tax Cost

ACC 418 Module 2 Assignment 2 Taxation Research and Communication

ACC 418 Module 3 Assignment 2 LASA 1 Tax Seminar

ACC 418 Module 4 Assignment 2 Constructive Dividends

ACC 418 Module 5 Assignment 1 LASA 2 Transfer Pricing

Description

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 1 Assignment 3 Calculating Tax Cost

ACC 418 Module 2 Assignment 2 Taxation Research and Communication

ACC 418 Module 3 Assignment 2 LASA 1 Tax Seminar

ACC 418 Module 4 Assignment 2 Constructive Dividends

ACC 418 Module 5 Assignment 1 LASA 2 Transfer Pricing

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 1 Assignment 3 Calculating Tax Cost

ACC418 Module 1 Assignment 3 Calculating Tax Cost

Microtech Software Corporation (MSC) was founded in 2001. The founder, Chan Li, studied at MIT and worked for a large software corporation before returning to his hometown, Centervale, to set up his own company.

The corporate tax rate structure applicable in Centervale is as follows:

Taxable Income

Tax Rate

Up to $50,000 15 percent

From $50,001 through $150,000 22 percent

Income in excess of $150,000 30 percent

MSC has an opportunity to invest in a project that is expected to generate an additional $55,000 of taxable income.

Compute the tax cost of this additional income for the following three scenarios:

MSC’s taxable income before the additional income is $45,000.

MSC’s taxable income before the additional income is $300,000.

MSC has a loss of $5,000 before considering the additional income.

Show all the steps of the calculation and the final answer for each scenario. Compare the results for the three scenarios and comment on any differences.

Write a one- to two-page paper in MS Word format. Apply APA standards for writing style to your work.

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 2 Assignment 2 Taxation Research and Communication

ACC 418 Module 2 Assignment 2 Taxation Research and Communication

The current tax law system in the United States has emerged over many years from statutory, administrative, and judicial sources. These sources are continually changing and new laws are introduced at least annually.

Suppose a client has come to you with a question about corporate taxation. Discuss your plan of action and communication with the client. Remember, the client does not have any technical background, and you need to communicate in terms he or she will understand.

Keeping this in mind, respond to the following:

What would be your plan of action?

What tax sources would you use to research the problem?

How would you communicate your findings to the client?

Write a three- to five-page paper in MS Word format. Apply APA standards for writing style to your work

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 3 Assignment 2 LASA 1 Tax Seminar

ACC 418 Module 3 Assignment 2 LASA 1 Tax Seminar

You are the instructor of a one-day tax seminar to inform international students studying business in the United States about the current tax system.

You are preparing a background report to help you prepare for the seminar. The report will include information about programs supported by tax revenue, the type of tax structure in the United States, primary and secondary sources for tax research, and a detailed example of the cash basis for tax purposes.

You are preparing the example to explain the cash basis to your students but need to detail the information in the report to be able explain it in the presentation.

In a six- to eight-page paper, prepare a report that addresses each of the following:

Describe at least three government programs supported by revenue from specific taxes (include specific examples).

For each program, specify the related tax, the entities or activities on which it is levied, and the tax rate.

Where possible, give quantitative information such as the proportion of tax revenue used for the program and the proportion of program expenses supported by the tax revenue.

Explain how the underlying principles of taxation relate to the programs supported by the taxes.

What type of tax rate structure does the U.S. tax system apply (include advantages and disadvantages of the current structure)?

Discuss the primary and secondary authoritative sources, provide a description of each, and detail the differences between them.

Based on the scenario below respond to the questions on using the cash basis.

XYZ Manufacturing, Inc., located in Centervale, uses the calendar year and the cash method of accounting.

On December 31, 2010, XYZ made the following cash payments:

$100,000 for a two-year office lease beginning on February 1, 2011

$58,000 of inventory items held for sale to customers

$21,800 to purchase new manufacturing equipment, which was delivered and set up on January 15, 2011

$10,000 compensation to the company’s auditors who spent three weeks in January 2011 analyzing XYZ’s internal control system, as a part of the annual audit

$30,500 property tax paid to the local government for the first six months of 2011

Respond to the following:

To what extent can XYZ deduct these payments in 2010? Explain your answer citing relevant rules and laws.

What advantages does the cash method of accounting offer to the company? Give reasons for your answer.

Would any other method offer an advantage? Give reasons for your answer.

Give detailed reasons for your responses and format your paper in APA. You should have at least six outside sources in addition to your textbook

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 4 Assignment 2 Constructive Dividends

ACC 418 Module 4 Assignment 2 Constructive Dividends

Suppose you are a CPA hired to represent a client that is currently under examination by the IRS. The client is the president and 95% shareholder of a building supply sales and warehousing business. He also owns 50% of the stock of a construction company.

The client’s son owns the remaining 50% of the stock of the construction company. The client has received a Notice of Proposed Adjustments (NPA) on three (3) significant issues related to the building supply business for the years under examination. The issues identified in the NPA are unreasonable compensation, stock redemptions, and a rental loss. Additional facts regarding the issues are reflected below:

Unreasonable compensation: The taxpayer receives a salary of $10 million composed of a $5 million base salary plus 5% of gross receipts not to exceed $5 million. The total gross receipts of the building supply business are $300 million.

The NPA by the IRS disallows the salary based on 5% of gross receipts as a constructive dividend.

Stock redemptions: During the audit period, the construction company redeemed 50% of the outstanding stock owned by the client and 50% of the stock owned by the client’s son, leaving each with the same ownership percentage of 50%. The IRS treated the redemption as a distribution under Section 301 of the IRC.

Rental loss: The rental loss results from a building leased to the construction company owned by the client and his son.

Use the Internet and Strayer databases to research the rules and income tax laws regarding unreasonable compensation, stock redemptions treated as dividends and related party losses. Be sure to use the six (6) step tax research process in Chapter 1 and demonstrated in Appendix A of your textbook as a guide for your written response.

Write a three to four (3-4) page paper in which you:

Based on your research and the facts stated in the scenario, prepare a recommendation for the client in which you advise either acceptance of the proposed adjustments or further appeal of the issue based on the potential for prevailing on appeal.

Create a tax plan for the future redemption of the client’s stock owned in the construction company that will not be taxed according to Section 301 of the IRC.

Propose a strategy for the client to receive similar amounts in compensation in the future and avoid the taxation as a constructive dividend.

Use the six (6) step tax research process, located in Chapter 1 and demonstrated in Appendix A of the textbook, to record your research for communications to the client.

Your assignment must follow these formatting requirements:

Be typed, double spaced, using Times New Roman font (size 12), with one-inch margins on all sides; citations and references must follow APA or school-specific format. Check with your professor for any additional instructions.

Include a cover page containing the title of the assignment, the student’s name, the professor’s name, the course title, and the date. The cover page and the reference page are not included in the required assignment page length.

The specific course learning outcomes associated with this assignment are:

Analyze tax issues regarding corporate formations, capital structures, income tax, non-liquidating distributions, or other corporate levies.

Prepare client, internal, and administrative documents that appropriately convey the results of tax research and planning.

Create an approach to tax research that results in credible and current resources.

Use technology and information resources to research issues in organizational tax research and planning.

Write clearly and concisely about organizational tax research and planning using proper writing mechanics.

ACC 418 ACC418 ACC/418 ENTIRE COURSE HELP – UNIVERSITY OF THE CUMBERLANDS

ACC 418 Module 5 Assignment 1 LASA 2 Transfer Pricing

ACC 418 Module 5 Assignment 1 LASA 2 Transfer Pricing

Transfer pricing is the pricing of assets, funds, services, etc., transferred among related organizations.

Using your textbook, the Argosy University online library resources, and the Internet, conduct research to discuss the transfer pricing regulations and select a recent case of transfer pricing.

Research the transfer pricing regulations, read the case, and write a six- to eight-page paper that includes the following:

Discuss the U.S transfer pricing regulations, including advance pricing agreements, arm’s length standard, and methods allowed to determine comparable prices.

Write a summary of your selected case.

Examine the tax, legal, and ethical issues in the case, and comment on the manner in which the case was handled by the organization and by the regulatory authority.

Propose your own solutions to the issues you identify in the case.

Give detailed reasons for your responses and format your paper in APA. You should have at least six outside sources in addition to your textbook.