ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

$149.99$275.00

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

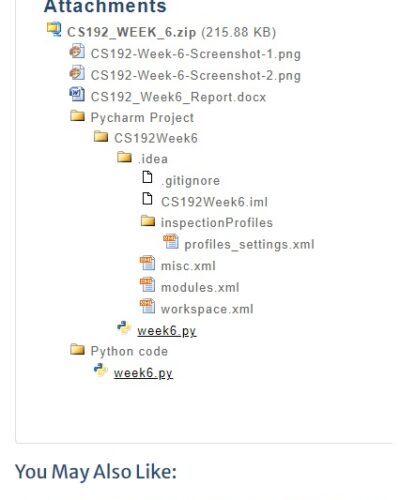

ACC 304 Final Exam Part 1 (3 Sets)

ACC 304 Final Exam Part 2 (2 Sets)

ACC 304 Week 1 Chapter 8 Homework

ACC 304 Week 10 Chapter 15 Quiz (All Possible Questions)

ACC 304 Week 10 Chapter 16 Homework

ACC 304 Week 2 Chapter 8 Quiz (All Possible Questions)

ACC 304 Week 2 Chapter 9 Homework

ACC 304 Week 3 Chapter 10 Homework

ACC 304 Week 3 Chapter 9 Quiz (All Possible Questions)

ACC 304 Week 4 Chapter 10 Quiz (All Possible Questions)

ACC 304 Week 4 Chapter 11 Homework

ACC 304 Week 5 Midterm Part 1 (Set 1)

ACC 304 Week 5 Midterm Part 1 (Set 2)

ACC 304 Week 5 Midterm Part 1 (Set 3)

ACC 304 Week 5 Midterm Part 2

ACC 304 Week 6 Chapter 12 Homework

ACC 304 Week 7 Chapter 12 Quiz (All Possible Questions)

ACC 304 Week 7 Chapter 13 Homework

ACC 304 Week 8 Assignment 1 Delta Airlines Property, Plant, And Equipment

ACC 304 Week 8 Chapter 14 Homework

ACC 304 Week 9 Chapter 13 and Chapter 14 Quiz (All Possible Questions)

ACC 304 Week 9 Chapter 15 Homework

Description

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Final Exam Part 1 (3 Sets)

ACC 304 Final Exam Part 2 (2 Sets)

ACC 304 Week 1 Chapter 8 Homework

ACC 304 Week 10 Chapter 15 Quiz (All Possible Questions)

ACC 304 Week 10 Chapter 16 Homework

ACC 304 Week 2 Chapter 8 Quiz (All Possible Questions)

ACC 304 Week 2 Chapter 9 Homework

ACC 304 Week 3 Chapter 10 Homework

ACC 304 Week 3 Chapter 9 Quiz (All Possible Questions)

ACC 304 Week 4 Chapter 10 Quiz (All Possible Questions)

ACC 304 Week 4 Chapter 11 Homework

ACC 304 Week 5 Midterm Part 1 (Set 1)

ACC 304 Week 5 Midterm Part 1 (Set 2)

ACC 304 Week 5 Midterm Part 1 (Set 3)

ACC 304 Week 5 Midterm Part 2

ACC 304 Week 6 Chapter 12 Homework

ACC 304 Week 7 Chapter 12 Quiz (All Possible Questions)

ACC 304 Week 7 Chapter 13 Homework

ACC 304 Week 8 Assignment 1 Delta Airlines Property, Plant, And Equipment

ACC 304 Week 8 Chapter 14 Homework

ACC 304 Week 9 Chapter 13 and Chapter 14 Quiz (All Possible Questions)

ACC 304 Week 9 Chapter 15 Homework

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Final Exam Part 1 (3 Sets)

This Tutorial contains 3 Set of Finals

ACC 304 Final Exam Part 1 (3 Sets) 1

1) Swing High Inc. offers its 100 employees to participate in an employee share-purchase plan. Under the terms of plan, employees are entitled to purchase 10 shares at 10% discount. The par values of shares were $10. Overall, 60 employees accepted the offer and each employee purchased six shares. The market price on purchase date was $100.

What is the compensation expense recorded by Swing High Inc.?

2) The interest rate written in the terms of the bond indenture is known as the

3) Which of the following methods of amortization is normally used for intangible assets?

4) If bonds are initially sold at a discount and the straight-line method of amortization is used, interest expense in the earlier years will

5) The distribution of stock rights to existing common stockholders will increase paid-in capital at the

6) Treasury shares are shares

7) Which of the following is a contract-related intangible assets?

8) Which of the following taxes does not represent a common employee payroll deduction?

9) On January 1, 2014, Ellison Co. issued eight-year bonds with a face value of $4,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are:

Present value of 1 for 8 periods at 6% .627

Present value of 1 for 8 periods at 8% .540

Present value of 1 for 16 periods at 3% .623

Present value of 1 for 16 periods at 4% .534

Present value of annuity for 8 periods at 6% 6.210

Present value of annuity for 8 periods at 8% 5.747

Present value of annuity for 16 periods at 3% 12.561

Present value of annuity for 16 periods at 4% 11.652

The present value of the interest is

10) Which of the following would be considered research and development costs?

11) On January 1, 2015, Evans Company granted Tim Telfer, an employee, an option to buy 3,000 shares of Evans Co. stock for $25 per share, the option exercisable for 5 years from date of grant. Using a fair value option pricing model, total compensation expense is determined to be $22,500. Telfer exercised his option on September 1, 2015, and sold his 1,000 shares on December 1, 2015. Quoted market prices of Evans Co. stock during 2015 were

January 1 $25 per share

September 1 $30 per share

December 1 $34 per share

The service period is for three years beginning January 1, 2015. As a result of the option granted to Telfer, using the fair value method, Evans should recognize compensation expense for 2015 on its books in the amount of

12) Presented below is information related to Hale Corporation:

Common Stock, $1 par $4,500,000

Paid-in Capital in Excess of Par―Common Stock 550,000

Preferred 8 1/2% Stock, $50 par 2,000,000

Paid-in Capital in Excess of Par―Preferred Stock 400,000

Retained Earnings 1,500,000

Treasury Common Stock (at cost) 150,000

The total paid-in capital (cash collected) related to the common stock is

13) On October 1, 2014 Macklin Corporation issued 5%, 10-year bonds with a face value of $4,000,000 at 104. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis.

Bond interest expense reported on the December 31, 2014 income statement of Macklin Corporation would be

14) Gannon Company acquired 10,000 shares of its own common stock at $20 per share on February 5, 2014, and sold 5,000 of these shares at $27 per share on August 9, 2015. The fair value of Gannon’s common stock was $24 per share at December 31, 2014, and $25 per share at December 31, 2015. The cost method is used to record treasury stock transactions. What account(s) should Gannon credit in 2015 to record the sale of 5,000 shares?

15) When computing diluted earnings per share, convertible bonds are

16) Jeff Corporation purchased a limited-life intangible asset for $225,000 on May 1, 2013. It has a useful life of 10 years. What total amount of amortization expense should have been recorded on the intangible asset by December 31, 2015?

17) A corporation called an outstanding bond obligation four years before maturity. At that time there was an unamortized discount of $750,000. To extinguish this debt, the company had to pay a call premium of $250,000. Ignoring income tax considerations, how should these amounts be treated for accounting purposes?

18) Slack Inc. borrowed $320,000 on April 1. The note requires interest at 12% and principal to be paid in one year. How much interest is recognized for the period from April 1 to December 31?

19) Venible newspapers sold 6,000 of annual subscriptions at $125 each on June 1. How much unearned revenue will exist as of December 31?

20) Hanson Co. had 200,000 shares of common stock, 20,000 shares of convertible preferred stock, and $1,000,000 of 5% convertible bonds outstanding during 2015. The preferred stock is convertible into 40,000 shares of common stock. During 2015, Hanson paid dividends of $.60 per share on the common stock and $2 per share on the preferred stock. Each $1,000 bond is convertible into 45 shares of common stock. The net income for 2015 was $400,000 and the income tax rate was 30%.

Basic earnings per share for 2015 is (rounded to the nearest penny)

21) Sealy Corporation had the following information in its financial statements for the years ended 2014 and 2015:

Cash dividends for the year 2015 $5,000

Net income for the year ended 2015 87,000

Market price of stock, 12/31/14 10

Market price of stock, 12/31/15 12

Common stockholders’ equity, 12/31/14 1,000,000

Common stockholders’ equity, 12/31/15 1,200,000

Outstanding shares, 12/31/15 100,000

Preferred dividends for the year ended 2015 10,000

What is the payout ratio for Sealy Corporation for the year ended 2015?

22) Jenks Corporation acquired Linebrink Products on January 1, 2015 for $8,000,000, and recorded goodwill of $1,500,000 as a result of that purchase. At December 31, 2015, Linebrink Products had a fair value of $6,800,000. The net identifiable assets of the Linebrink (excluding goodwill) had a fair value of $5,800,000 at that time. What amount of loss on impairment of goodwill should Jenks record in 2015?

23) On December 31, 2014, the stockholders’ equity section of Arndt, Inc., was as follows:

Common stock, par value $10; authorized 30,000 shares;

issued and outstanding 9,000 shares $90,000

Additional paid-in capital 116,000

Retained earnings 184,000

Total stockholders’ equity $390,000

On March 31, 2015, Arndt declared a 10% stock dividend, and accordingly 900 additional shares were issued, when the fair value of the stock was $18 per share. For the three months ended March 31, 2015, Arndt sustained a net loss of $32,000. The balance of Arndt’s retained earnings as of March 31, 2015, should be

24) On September 1, 2014, Halley Co. issued a note payable to Fidelity Bank in the amount of $1,800,000, bearing interest at 10%, and payable in three equal annual principal payments of $600,000. On this date, the bank’s prime rate was 11%. The first payment for interest and principal was made on September 1, 2015. At December 31, 2015, Halley should record accrued interest payable of

ACC 304 Final Exam Part 1 (3 Sets) 2

1) We have also attached download of Chapter 12, 13, 14, 15, 16 (download it from my account section)

Please use those as well for your finals and please either use the question number or some data from question to search as they usually change the company keeping the data same

2) Convertible bonds

3) Litke Corporation issued at a premium of $5,000 a $100,000 bond issue convertible into 2,000 shares of common stock (par value $20). At the time of the conversion, the unamortized premium is $2,000, the market value of the bonds is $110,000, and the stock is quoted on the market at $60 per share. If the bonds are converted into common, what is the amount of paid-in capital in excess of par to be recorded on the conversion of the bonds?

4) Didde Co. had 300,000 shares of common stock issued and outstanding at December 31, 2014. No common stock was issued during 2015. On January 1, 2015, Didde issued 200,000 shares of nonconvertible preferred stock. During 2015, Didde declared and paid $75,000 cash dividends on the common stock and $60,000 on the preferred stock. Net income for the year ended December 31, 2015 was $465,000. What should be Didde’s 2015 earnings per common share?

5) Weiser Corp. on January 1, 2012, granted stock options for 40,000 shares of its $10 par value common stock to its key employees. The market price of the common stock on that date was $23 per share and the option price was $20. The Black-Scholes option pricing model determines total compensation expense to be $420,000. The options are exercisable beginning January 1, 2015, provided those key employees are still in Weiser’s employ at the time the options are exercised. The options expire on January 1, 2016.

On January 1, 2015, when the market price of the stock was $29 per share, all 40,000 options were exercised. The amount of compensation expense Weiser should record for 2015 under the fair value method is

6) Carr Corporation retires its $300,000 face value bonds at 105 on January 1, following the payment of interest. The carrying value of the bonds at the redemption date is $311,235. The entry to record the redemption will include a

7) On October 1, 2014 Macklin Corporation issued 5%, 10-year bonds with a face value of $4,000,000 at 104. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis.

The entry to record the issuance of the bonds would include a credit of

8) Farmer Company issues $25,000,000 of 10-year, 9% bonds on March 1, 2014 at 97 plus accrued interest. The bonds are dated January 1, 2014, and pay interest on June 30 and December 31. What is the total cash received on the issue date?

9) On its December 31, 2014 balance sheet, Emig Corp. reported bonds payable of $3,000,000 and related unamortized bond issue costs of $160,000. The bonds had been issued at par. On January 2, 2015, Emig retired $1,500,000 of the outstanding bonds at par plus a call premium of $35,000. What amount should Emig report in its 2015 income statement as loss on extinguishment of debt (ignore taxes)?

10) Feller Company issues $15,000,000 of 10-year, 9% bonds on March 1, 2014 at 97 plus accrued interest. The bonds are dated January 1, 2014, and pay interest on June 30 and December 31. What is the total cash received on the issue date?

11) Where is debt callable by the creditor reported on the debtor’s financial statements?

12) Sawyer Company self-insures its property for fire and storm damage. If the company were to obtain insurance on the property, it would cost them $1,500,000 per year. The company estimates that on average it will incur losses of $1,200,000 per year. During 2014, $525,000 worth of losses were sustained. How much total expense and/or loss should be recognized by Sawyer Company for 2014?

13) A liability for compensated absences such as vacations, for which it is expected that employees will be paid, should

14) On September 1, Horton purchased $13,300 of inventory items on credit with the terms 1/15, net 30, FOB destination. Freight charges were $280. Payment for the purchase was made on September 18. Assuming Horton uses the perpetual inventory system and the net method of accounting for purchase discounts, what amount is recorded as inventory from this purchase?

15) What is a discount as it relates to zero-interest-bearing notes payable?

16) Which of the following legal fees should be capitalized?

17) Which of the following costs of goodwill should be amortized over their estimated useful lives?

18) MaBelle Corporation incurred the following costs in 2015:

Acquisition of R&D equipment with a useful life of 4 years in R&D projects $800,000

Start-up costs incurred when opening a new plant 140,000

Advertising expense to introduce a new product 700,000

Engineering costs incurred to advance a product to full production stage 500,000

What amount should MaBelle record as research & development expense in 2015?

19) Jenks Corporation acquired Linebrink Products on January 1, 2015 for $8,000,000, and recorded goodwill of $1,500,000 as a result of that purchase. At December 31, 2015, Linebrink Products had a fair value of $6,800,000. The net identifiable assets of the Linebrink (excluding goodwill) had a fair value of $5,800,000 at that time. What amount of loss on impairment of goodwill should Jenks record in 2015?

20) The general ledger of Vance Corporation as of December 31, 2015, includes the following accounts:

Copyrights $30,000

Deposits with advertising agency (will be used to promote goodwill) 27,000

Discount on bonds payable 70,000

Excess of cost over fair value of identifiable net assets of Acquired subsidiary 480,000

Trademarks 90,000

In the preparation of Vance’s balance sheet as of December 31, 2015, what should be reported as total intangible assets?

21) Sealy Corporation had the following information in its financial statements for the years ended 2014 and 2015:

Cash dividends for the year 2015 $5,000

Net income for the year ended 2015 87,000

Market price of stock, 12/31/14 10

Market price of stock, 12/31/15 12

Common stockholders’ equity, 12/31/14 1,000,000

Common stockholders’ equity, 12/31/15 1,200,000

Outstanding shares, 12/31/15 100,000

Preferred dividends for the year ended 2015 10,000

What is the rate of return on common stock equity for Sealy Corporation for the year ended 2015?

22) An entry is not made on the

23) The issuer of a 5% common stock dividend to common stockholders should transfer from retained earnings to paid-in capital an amount equal to the

24) Layne Corporation had the following information in its financial statements for the years ended 2014 and 2015:

Cash dividends for the year 2015 $10,000

Net income for the year ended 2015 83,000

Market price of stock, 12/31/14 10

Market price of stock, 12/31/15 12

Common stockholders’ equity, 12/31/14 1,600,000

Common stockholders’ equity, 12/31/15 1,980,000

Outstanding shares, 12/31/15 180,000

Preferred dividends for the year ended 2015 15,000

What is the book value per share for Layne Corporation for the year ended 2015?

25) The pre-emptive right of a common stockholder is the right to

ACC 304 Final Exam Part 1 (3 Sets)

1) Swing High Inc. offers its 100 employees to participate in an employee share-purchase plan. Under the terms of plan, employees are entitled to purchase 10 shares at 10% discount. The par values of shares were $10. Overall, 60 employees accepted the offer and each employee purchased six shares. The market price on purchase date was $100.

2) Didde Co. had 300,000 shares of common stock issued and outstanding at December 31, 2014. No common stock was issued during 2015. On January 1, 2015, Didde issued 200,000 shares of nonconvertible preferred stock. During 2015, Didde declared and paid $75,000 cash dividends on the common stock and $60,000 on the preferred stock. Net income for the year ended December 31, 2015 was $465,000. What should be Didde’s 2015 earnings per common share?

3) When convertible debt is retired by the issuer, any material difference between the cash acquisition price and the carrying amount of the debt should be

4) On July 1, 2014, an interest payment date, $90,000 of Parks Co. bonds were converted into 1,800 shares of Parks Co. common stock each having a par value of $45 and a market value of $54. There is $3,600 unamortized discount on the bonds. Using the book value method, Parks would record

5) Convertible bonds

6) Paige Co. took advantage of market conditions to refund debt. This was the fourth refunding operation carried out by Paige within the last three years. The excess of the carrying amount of the old debt over the amount paid to extinguish it should be reported as a

7) Under the effective-interest method of bond discount or premium amortization, the periodic interest expense is equal to

8) When a business enterprise enters into what is referred to as off-balance-sheet financing, the company

9) When the interest payment dates of a bond are May 1 and November 1, and a bond issue is sold on June 1, the amount of cash received by the issuer will be

10) On October 1, 2014 Macklin Corporation issued 5%, 10-year bonds with a face value of $4,000,000 at 104. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis.

11) Which of the following taxes does not represent a common employee payroll deduction?

12) Which of the following is an example of a contingent liability?

13) Sawyer Company self-insures its property for fire and storm damage. If the company were to obtain insurance on the property, it would cost them $1,500,000 per year. The company estimates that on average it will incur losses of $1,200,000 per year. During 2014, $525,000 worth of losses were sustained. How much total expense and/or loss should be recognized by Sawyer Company for 2014?

14) Greeson Corp. signed a three-month, zero-interest-bearing note on November 1, 2014 for the purchase of $250,000 of inventory. The face value of the note was $253,900. Greeson used a “Discount on Note Payable” account to initially record the note. Assuming that the discount will be amortized equally over the 3-month period and that there was no adjusting entry made for November, the adjusting entry made at December 31, 2012 will include a

15) Presented below is information available for Marley Company.

Current Assets

Cash $ 4,000

Short-term investments 65,000

Accounts receivable 61,000

Inventories 110,000

Prepaid expenses 30,000

Total current assets $ 270,000

16) In accounting for internally generated intangible assets, U.S. GAAP requires that

17) One factor that is not considered in determining the useful life of an intangible asset is

18) In 2015, Edwards Corporation incurred research and development costs as follows:

Materials and equipment $110,000

Personnel 130,000

Indirect costs 150,000

$390,000

These costs relate to a product that will be marketed in 2016. It is estimated that these costs will be recouped by December 31, 2018. The equipment has no alternative future use. What is the amount of research and development costs that should be expensed in 2015?

19) The carrying value of an intangible is

20) Under current accounting practice, intangible assets are classified as

21) The statement of changes in equity has columns for each of the following except:

22) The pre-emptive right of a common stockholder is the right to

23) Total stockholders’ equity represents

24) The issuer of a 5% common stock dividend to common stockholders should transfer from retained earnings to paid-in capital an amount equal to the

25) Which of the following features of preferred stock makes it more like a debt than an equity instrument?

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Final Exam Part 2 (2 Sets)

ACC 304 Final Exam Part 2 (2 Sets) 1

1) On January 1, 2015, Piper Co. issued ten-year bonds with a face value of $3,000,000 and a stated interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are:

Present value of 1 for 10 periods at 10% .386

Present value of 1 for 10 periods at 12% .322

Present value of 1 for 20 periods at 5% .377

Present value of 1 for 20 periods at 6% .312

Present value of annuity for 10 periods at 10% 6.145

Present value of annuity for 10 periods at 12% 5.650

Present value of annuity for 20 periods at 5% 12.462

Present value of annuity for 20 periods at 6% 11.470

2) Without prejudice to your solution in part (a), assume that the issue price was $2,652,000. Prepare the amortization table for 2015, assuming that amortization is recorded on interest payment dates using the effective-interest method.

3) The following information pertains to Parsons Co.:

Preferred stock, cumulative:

Par value per share $100

Dividend rate 8%

Shares outstanding 9,000

Dividends in arrears none

Common stock:

Par value per share $10

Shares issued 100,000

Dividends paid per share $2.00

Market price per share $47

Additional paid-in capital $480,000

Unappropriated retained earnings (after closing) $250,000

Retained earnings appropriated for contingencies $280,000

Common treasury stock:

Number of shares 9,000

Total cost $240,000

Net income $610,000

Compute (assume no changes in balances during the past year): (Round per share and ratios to 2 decimal places, e.g. $15.75 or 15.75%.)

(a) Total amount of stockholders’ equity in the balance sheet $

(b) Earnings per share of common stock $

per share

(c) Book value per share of common stock $

per share

(d) Payout ratio of common stock

%

(e) Return on common stock equity

%

4) Sisco Co. purchased a patent from Thornton Co. for $620,000 on July 1, 2012. Expenditures of $119,000 for successful litigation in defense of the patent were paid on July 1, 2015. Sisco estimates that the useful life of the patent will be 20 years from the date of acquisition.

Prepare a computation of the carrying value of the patent at December 31, 2015.

5) On August 31, Latty Co. partially refunded $401,000 of its outstanding 10% note payable made one year ago to Dugan State Bank by paying $401,000 plus $40,100 interest, having obtained the $441,100 by using $126,240 cash and signing a new one-year $346,000 note discounted at 9% by the bank.

6) Make the entry to record the partial refunding. Assume Latty Co. makes reversing entries when appropriate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

6)

7) Prepare the adjusting entry at December 31, assuming straight-line amortization of the discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

ACC 304 Final Exam Part 2 (2 Sets)

1) The following information pertains to Parsons Co.:

Preferred stock, cumulative:

Par value per share $100

Dividend rate 8%

Shares outstanding 9,000

Dividends in arrears none

Common stock:

Par value per share $10

Shares issued 100,000

Dividends paid per share $2.00

Market price per share $47

Additional paid-in capital $480,000

Unappropriated retained earnings (after closing) $250,000

Retained earnings appropriated for contingencies $280,000

Common treasury stock:

Number of shares 9,000

Total cost $240,000

Net income $610,000

Compute (assume no changes in balances during the past year): (Round per share and ratios to 2 decimal places, e.g. $15.75 or 15.75%.)

(a) Total amount of stockholders’ equity in the balance sheet $

(b) Earnings per share of common stock $

per share

(c) Book value per share of common stock $

per share

(d) Payout ratio of common stock

%

(e) Return on common stock equity

%

2) On January 1, 2015, Piper Co. issued ten-year bonds with a face value of $3,000,000 and a stated interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are:

Present value of 1 for 10 periods at 10% .386

Present value of 1 for 10 periods at 12% .322

Present value of 1 for 20 periods at 5% .377

Present value of 1 for 20 periods at 6% .312

Present value of annuity for 10 periods at 10% 6.145

Present value of annuity for 10 periods at 12% 5.650

Present value of annuity for 20 periods at 5% 12.462

Present value of annuity for 20 periods at 6% 11.470

3) Calculate the issue price of the bonds.

Issue price of bond

4) Without prejudice to your solution in part (a), assume that the issue price was $2,652,000. Prepare the amortization table for 2015, assuming that amortization is recorded on interest payment dates using the effective-interest method.

5) Sisco Co. purchased a patent from Thornton Co. for $620,000 on July 1, 2012. Expenditures of $119,000 for successful litigation in defense of the patent were paid on July 1, 2015. Sisco estimates that the useful life of the patent will be 20 years from the date of acquisition.

Prepare a computation of the carrying value of the patent at December 31, 2015.

6) On August 31, Latty Co. partially refunded $443,000 of its outstanding 10% note payable made one year ago to Dugan State Bank by paying $443,000 plus $44,300 interest, having obtained the $487,300 by using $134,220 cash and signing a new one-year $388,000 note discounted at 9% by the bank.

7) Make the entry to record the partial refunding. Assume Latty Co. makes reversing entries when appropriate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

8) Prepare the adjusting entry at December 31, assuming straight-line amortization of the discount. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date Account Titles and Explanation Debit Credit

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 1 Chapter 8 Homework

1) Matlock Company uses a perpetual inventory system. Its beginning inventory consists 50 units that cost $34 each. During June , (1) the company purchased units at $34 each, (2) returned 6 units for credit ,and (3) sold 125 unit at $50 each. Journalize the June transactions.

2) Amsterdam Company uses a periodic inventory system. For April, When the company sold 600 units, The following information is available. calculate weighted average cost per unit.

3) Arna, Inc. uses the dollar value LIFO method of computing its inventory. Data for the past 3 year follow. Compute the value of the 2014 and 2015 inventories using the dollar-value LIFE method.

4) Craig Company asks you to review its December 31, 2014, inventory values and prepare the necessary adjustments to the book. The following information is given to u. determine the proper inventory balance for Craig Company at December 31, 2014.

5) Prepare any correcting entries to adjust inventory to its proper amount at December 31, 2014. Assume the books have not been closed.

6) The net income per books of Linda Patrick Company was determined without knowledge of the errors indicated below. Prepare work sheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors.

7) Presented below the information related to Dino Radja Company. Compute the ending inventory for Dino Radja Company for 2011 throw 2016 using the Dollar value LIFO method.

8) Under IFRS, an entity should initially recognize inventory when

9) With respect to accounting of inventories, which of the following is a difference that exists for IFRS, as opposed to U.S GAAP?

10) Some of the transactions of Torres Company during August are listed below. Torres uses the periodic inventory method.

11) Assuming that purchases are recorded at gross amounts and that discounts are to be recorded when taken: prepare general journal entries to record the transactions

12) Assuming that purchases are recorded at net amounts and that discounts lost are treated as financial expenses: prepare general journal entries to record the transactions

13) Assuming that purchases are recorded at net amounts and that discounts lost are treated as financial expenses: prepare the adjusting entry necessary on August 31 if financial statements are to be prepared at that time.

14) Under IFRS, which of the following would be included in the cost of inventories?

15) Under IFRS, inventories are classified as

16) Which of the following best describes the IFRS requirement for applying the same cost formula to all inventories?

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 10 Chapter 15 Quiz (All Possible Questions)

ACC 304 Week 10 Quiz – Strayer NEW

Week 10 Quiz 7: Chapter 15

STOCKHOLDERS’ EQUITY

IFRS questions are available at the end of this chapter.

TRUE-FALSE—Conceptual

1. A corporation is incorporated in only one state regardless of the number of states in which it operates.

2. The preemptive right allows stockholders the right to vote for directors of the company.

3. Common stock is the residual corporate interest that bears the ultimate risks of loss.

4. Earned capital consists of additional paid-in capital and retained earnings.

5. True no-par stock should be carried in the accounts at issue price without any additional paid-in capital reported.

6. Companies allocate the proceeds received from a lump-sum sale of securities based on the securities’ par values.

7. Companies should record stock issued for services or noncash property at either the fair value of the stock issued or the fair value of the consideration received.

8. Treasury stock is a company’s own stock that has been reacquired and retired

9. The cost method records all transactions in treasury shares at their cost and reports the treasury stock as a deduction from capital stock.

10. When a corporation sells treasury stock below its cost, it usually debits the difference between cost and selling price to Paid-in Capital from Treasury Stock.

11. Participating preferred stock requires that if a company fails to pay a dividend in any year, it must make it up in a later year before paying any common dividends.

12. Callable preferred stock permits the corporation at its option to redeem the outstanding preferred shares at stipulated prices.

13. The laws of some states require that corporations restrict their legal capital from distribution to stockholders.

14. The SEC requires companies to disclose their dividend policy in their annual report.

15. All dividends, except for liquidating dividends, reduce the total stockholders’ equity of a corporation

16. Dividends payable in assets of the corporation other than cash are called property dividends or dividends in kind.

17. When a stock dividend is less than 20-25 percent of the common stock outstanding, a company is required to transfer the fair value of the stock issued from retained earnings.

18. Stock splits and large stock dividends have the same effect on a company’s retained earnings and total stockholders’ equity.

19. The rate of return on common stock equity is computed by dividing net income by the average common stockholders’ equity.

20. The payout ratio is determined by dividing cash dividends paid to common stockholders by net income available to common stockholders.

True-False Answers—Conceptual

MULTIPLE CHOICE—Conceptual

21. The residual interest in a corporation belongs to the

a. management.

b. creditors.

c. common stockholders.

d. preferred stockholders.

22. The pre-emptive right of a common stockholder is the right to

a. share proportionately in corporate assets upon liquidation.

b. share proportionately in any new issues of stock of the same class.

c. receive cash dividends before they are distributed to preferred stockholders.

d. exclude preferred stockholders from voting rights.

23. The pre-emptive right enables a stockholder to

a. share proportionately in any new issues of stock of the same class.

b. receive cash dividends before other classes of stock without the pre-emptive right.

c. sell capital stock back to the corporation at the option of the stockholder.

d. receive the same amount of dividends on a percentage basis as the preferred stockholders.

S24. In a corporate form of business organization, legal capital is best defined as

a. the amount of capital the state of incorporation allows the company to accumulate over its existence.

b. the par value of all capital stock issued.

c. the amount of capital the federal government allows a corporation to generate.

d. the total capital raised by a corporation within the limits set by the Securities and Exchange Commission.

S25. Stockholders of a business enterprise are said to be the residual owners. The term residual owner means that shareholders

a. are entitled to a dividend every year in which the business earns a profit.

b. have the rights to specific assets of the business.

c. bear the ultimate risks and uncertainties and receive the benefits of enterprise ownership.

d. can negotiate individual contracts on behalf of the enterprise.

26. Total stockholders’ equity represents

a. a claim to specific assets contributed by the owners.

b. the maximum amount that can be borrowed by the enterprise.

c. a claim against a portion of the total assets of an enterprise.

d. only the amount of earnings that have been retained in the business.

27. A primary source of stockholders’ equity is

a. income retained by the corporation.

b. appropriated retained earnings.

c. contributions by stockholders.

d. both income retained by the corporation and contributions by stockholders.

28. Stockholders’ equity is generally classified into two major categories:

a. contributed capital and appropriated capital.

b. appropriated capital and retained earnings.

c. retained earnings and unappropriated capital.

d. earned capital and contributed capital.

29. The accounting problem in a lump sum issuance is the allocation of proceeds between the classes of securities. An acceptable method of allocation is the

a. pro forma method.

b. proportional method.

c. incremental method.

d. either the proportional method or the incremental method.

30. When a corporation issues its capital stock in payment for services, the least appropriate basis for recording the transaction is the

a. market value of the services received.

b. par value of the shares issued.

c. market value of the shares issued.

d. Any of these provides an appropriate basis for recording the transaction.

31. Direct costs incurred to sell stock such as underwriting costs should be accounted for as

1. a reduction of additional paid-in capital.

2. an expense of the period in which the stock is issued.

3. an intangible asset.

a. 1

b. 2

c. 3

d. 1 or 3

32. A “secret reserve” will be created if

a. inadequate depreciation is charged to income.

b. a capital expenditure is charged to expense.

c. liabilities are understated.

d. stockholders’ equity is overstated.

P33. Which of the following represents the total number of shares that a corporation may issue under the terms of its charter?

a. authorized shares

b. issued shares

c. unissued shares

d. outstanding shares

S34. Stock that has a fixed per-share amount printed on each stock certificate is called

a. stated value stock.

b. fixed value stock.

c. uniform value stock.

d. par value stock.

S35. Which of the following is not a legal restriction related to profit distributions by a corporation?

a. The amount distributed to owners must be in compliance with the state laws governing corporations.

b. The amount distributed in any one year can never exceed the net income reported for that year.

c. Profit distributions must be formally approved by the board of directors.

d. Dividends must be in full agreement with the capital stock contracts as to preferences and participation.

S36. In January 2012, Finley Corporation, a newly formed company, issued 10,000 shares of its $10 par common stock for $15 per share. On July 1, 2012, Finley Corporation reacquired 1,000 shares of its outstanding stock for $12 per share. The acquisition of these treasury shares

a. decreased total stockholders’ equity.

b. increased total stockholders’ equity.

c. did not change total stockholders’ equity.

d. decreased the number of issued shares.

P37. Treasury shares are

a. shares held as an investment by the treasurer of the corporation.

b. shares held as an investment of the corporation.

c. issued and outstanding shares.

d. issued but not outstanding shares.

38. When treasury stock is purchased for more than the par value of the stock and the cost method is used to account for treasury stock, what account(s) should be debited?

a. Treasury stock for the par value and paid-in capital in excess of par for the excess of the purchase price over the par value.

b. Paid-in capital in excess of par for the purchase price.

c. Treasury stock for the purchase price.

d. Treasury stock for the par value and retained earnings for the excess of the purchase price over the par value.

39. “Gains” on sales of treasury stock (using the cost method) should be credited to

a. paid-in capital from treasury stock.

b. capital stock.

c. retained earnings.

d. other income.

40. Porter Corp. purchased its own par value stock on January 1, 2012 for $20,000 and debited the treasury stock account for the purchase price. The stock was subsequently sold for $12,000. The $8,000 difference between the cost and sales price should be recorded as a deduction from

a. additional paid-in capital to the extent that previous net “gains” from sales of the same class of stock are included therein; otherwise, from retained earnings.

b. additional paid-in capital without regard as to whether or not there have been previous net “gains” from sales of the same class of stock included therein.

c. retained earnings.

d. net income.

41. How should a “gain” from the sale of treasury stock be reflected when using the cost method of recording treasury stock transactions?

a. As ordinary earnings shown on the income statement.

b. As paid-in capital from treasury stock transactions.

c. As an increase in the amount shown for common stock.

d. As an extraordinary item shown on the income statement.

42. Which of the following best describes a possible result of treasury stock transactions by a corporation?

a. May increase but not decrease retained earnings.

b. May increase net income if the cost method is used.

c. May decrease but not increase retained earnings.

d. May decrease but not increase net income.

43. Which of the following features of preferred stock makes the security more like debt than an equity instrument?

a. Participating

b. Voting

c. Redeemable

d. Noncumulative

44. The cumulative feature of preferred stock

a. limits the amount of cumulative dividends to the par value of the preferred stock.

b. requires that dividends not paid in any year must be made up in a later year before dividends are distributed to common shareholders.

c. means that the shareholder can accumulate preferred stock until it is equal to the par value of common stock at which time it can be converted into common stock.

d. enables a preferred stockholder to accumulate dividends until they equal the par value of the stock and receive the stock in place of the cash dividends.

P45. According to the FASB, redeemable preferred stock should be

a. included with common stock.

b. included as a liability.

c. excluded from the stockholders’ equity heading.

d. included as a contra item in stockholders’ equity.

S46. Cumulative preferred dividends in arrears should be shown in a corporation’s balance sheet as

a. an increase in current liabilities.

b. an increase in stockholders’ equity.

c. a footnote.

d. an increase in current liabilities for the current portion and long-term liabilities for the long-term portion.

47. At the date of the financial statements, common stock shares issued would exceed common stock shares outstanding as a result of the

a. declaration of a stock split.

b. declaration of a stock dividend.

c. purchase of treasury stock.

d. payment in full of subscribed stock.

48. An entry is not made on the

a. date of declaration.

b. date of record.

c. date of payment.

d. An entry is made on all of these dates.

49. Cash dividends are paid on the basis of the number of shares

a. authorized.

b. issued.

c. outstanding.

d. outstanding less the number of treasury shares.

50. Which of the following statements about property dividends is not true?

a. A property dividend is usually in the form of securities of other companies.

b. A property dividend is also called a dividend in kind.

c. The accounting for a property dividend should be based on the carrying value (book value) of the nonmonetary assets transferred.

d. All of these statements are true.

51. Houser Corporation owns 4,000,000 shares of stock in Baha Corporation. On December 31, 2012, Houser distributed these shares of stock as a dividend to its stockholders. This is an example of a

a. property dividend.

b. stock dividend.

c. liquidating dividend.

d. cash dividend.

52. A dividend which is a return to stockholders of a portion of their original investments is a

a. liquidating dividend.

b. property dividend.

c. liability dividend.

d. participating dividend.

53. A mining company declared a liquidating dividend. The journal entry to record the declaration must include a debit to

a. Retained Earnings.

b. a paid-in capital account.

c. Accumulated Depletion.

d. Accumulated Depreciation.

54. If management wishes to “capitalize” part of the earnings, it may issue a

a. cash dividend.

b. stock dividend.

c. property dividend.

d. liquidating dividend.

55. Which dividends do not reduce stockholders’ equity?

a. Cash dividends

b. Stock dividends

c. Property dividends

d. Liquidating dividends

56. The declaration and issuance of a stock dividend larger than 25% of the shares previously outstanding

a. increases common stock outstanding and increases total stockholders’ equity.

b. decreases retained earnings but does not change total stockholders’ equity.

c. may increase or decrease paid-in capital in excess of par but does not change total stockholders’ equity.

d. increases retained earnings and increases total stockholders’ equity.

57. Quirk Corporation issued a 100% stock dividend of its common stock which had a par value of $10 before and after the dividend. At what amount should retained earnings be capitalized for the additional shares issued?

a. There should be no capitalization of retained earnings.

b. Par value

c. Fair value on the declaration date

d. Fair value on the payment date

58. The issuer of a 5% common stock dividend to common stockholders preferably should transfer from retained earnings to contributed capital an amount equal to the

a. fair value of the shares issued.

b. book value of the shares issued.

c. minimum legal requirements.

d. par or stated value of the shares issued.

59. At the date of declaration of a small common stock dividend, the entry should not include

a. a credit to Common Stock Dividend Payable.

b. a credit to Paid-in Capital in Excess of Par.

c. a debit to Retained Earnings.

d. All of these are acceptable.

60. The balance in Common Stock Dividend Distributable should be reported as a(n)

a. deduction from common stock issued.

b. addition to capital stock.

c. current liability.

d. contra current asset.

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 10 Chapter 16 Homework

1) Archer Inc. issued $4,461,300 par value, 7% convertible bonds at 99 for cash. If the bonds had not included the conversion feature, they would have sold for 95.

Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Account Titles and Explanation Debit Credit

2) On January 1, 2014, Barwood Corporation granted 5,360 options to executives. Each option entitles the holder to purchase one share of Barwood’s $5 par value common stock at $50 per share at any time during the next 5 years. The market price of the stock is $73 per share on the date of grant. The fair value of the options at the grant date is $150,800. The period of benefit is 2 years.

Prepare Barwood’s journal entries for January 1, 2014, and December 31, 2014 and 2015. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

3) Tomba Corporation had 546,600 shares of common stock outstanding on January 1, 2014. On May 1, Tomba issued 51,000 shares.

4) For each of the unrelated transactions described below, present the entries required to record each transaction.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

5) Illiad Inc. has decided to raise additional capital by issuing $176,300 face value of bonds with a coupon rate of 11%. In discussions with investment bankers, it was determined that to help the sale of the bonds, detachable stock warrants should be issued at the rate of one warrant for each $100 bond sold. The value of the bonds without the warrants is considered to be $139,570, and the value of the warrants in the market is $24,630. The bonds sold in the market at issuance for $156,000.

(a) What entry should be made at the time of the issuance of the bonds and warrants? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

Account Titles and Explanation Debit Credit

(b) Prepare the entry if the warrants were nondetachable. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

6) Tweedie Company issues 10,500 shares of restricted stock to its CFO, Mary Tokar, on January 1, 2014. The stock has a fair value of $525,000 on this date. The service period related to this restricted stock is 5 years. Vesting occurs if Tokar stays with the company until December 31, 2018. The par value of the stock is $10. At December 31, 2014, the fair value of the stock is $481,300.

(a) Prepare the journal entries to record the restricted stock on January 1, 2014 (the date of grant), and December 31, 2015. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

(b) On July 25, 2018, Tokar leaves the company. Prepare the journal entry to account for this forfeiture. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.)

7) On January 1, 2015, Wilke Corp. had 501,000 shares of common stock outstanding. During 2015, it had the following transactions that affected the Common Stock account.

February 1 Issued 142,000 shares

March 1 Issued a 10% stock dividend

May 1 Acquired 115,000 shares of treasury stock

June 1 Issued a 3-for-1 stock split

October 1 Reissued 67,800 shares of treasury stock

a.)Determine the weighted-average number of shares outstanding as of December 31, 2015.

b.)Assume that Wilke Corp. earned net income of $3,315,000 during 2015. In addition, it had 117,000 shares of 9%, $102 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2015. Compute earnings per share for 2015, using the weighted-average number of shares determined in part (a

c.)Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earnings per share for 2015. (Round answer to 2 decimal places, e.g. $2.55.)

d.)Assume the same facts as in part (b), except that net income included an extraordinary gain of $941,000 and a loss from discontinued operations of $489,000. Both items are net of applicable income taxes. Compute earnings per share for 2015. (Round answer to 2 decimal places, e.g. $2.55.)

8) Amy Dyken, controller at Fitzgerald Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Fitzgerald’s financial statements. Below is selected financial information for the fiscal year ended June 30, 2014.

9) Under IFRS, how are convertible debt recorded?

10) Under IFRS, what is recorded as compensation expense for all employee share-purchase plans?

11) Which of the following differs in GAAP and IFRS?

12) Florence Inc. issued 8,000, 5-year convertible bonds of $2,000 each for $4,000,000 at the beginning of 2012. The bonds have a stated rate of interest of 9% and interest is payable annually. Each bond can be convertible into 100 shares with a par value of $10. The market rate of similar nonconvertible debt is 10%.

Determine the fair value of equity component using the “with-and-without” method.

13) Swing High Inc. offers its 100 employees to participate in an employee share-purchase plan. Under the terms of plan, employees are entitled to purchase 10 shares at 10% discount. The par values of shares were $10. Overall, 60 employees accepted the offer and each employee purchased six shares. The market price on purchase date was $100.

Swing High Inc. will credit Share Premium―Ordinary for:

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 2 Chapter 8 Quiz (All Possible Questions)

ACC 304 Week 2 Quiz – Strayer NEW

CHAPTER 8

VALUATION OF INVENTORIES:A COST-BASIS APPROACH

IFRS questions are available at the end of this chapter.

TRUE FALSE—Conceptual

1. A manufacturing concern would report the cost of units only partially processed as inventory in the balance sheet.

2. Both merchandising and manufacturing companies normally have multiple inventory accounts.

3. When using a perpetual inventory system, freight charges on goods purchased are debited to Freight-In.

4. If a supplier ships goods f.o.b. destination, title passes to the buyer when the supplier delivers the goods to the common carrier.

5. If ending inventory is understated, then net income is understated.

6. If both purchases and ending inventory are overstated by the same amount, net income is not affected.

7. Freight charges on goods purchased are considered a period cost and therefore are not part of the cost of the inventory.

8. Purchase Discounts Lost is a financial expense and is reported in the “other expenses and losses” section of the income statement.

9. The cost flow assumption adopted must be consistent with the physical movement of the goods.

10. In all cases when FIFO is used, the cost of goods sold would be the same whether a perpetual or periodic system is used.

11. The change in the LIFO Reserve from one period to the next is recorded as an adjustment to Cost of Goods Sold.

12. Many companies use LIFO for both tax and internal reporting purposes.

13. LIFO liquidation often distorts net income, but usually leads to substantial tax savings.

14. LIFO liquidations can occur frequently when using a specific-goods approach.

15. Dollar-value LIFO techniques help protect LIFO layers from erosion.

16. The dollar-value LIFO method measures any increases and decreases in a pool in terms of total dollar value and physical quantity of the goods.

17. A disadvantage of LIFO is that it does not match more recent costs against current revenues as well as FIFO.

18. The LIFO conformity rule requires that if a company uses LIFO for tax purposes, it must also use LIFO for financial accounting purposes.

19. Use of LIFO provides a tax benefit in an industry where unit costs tend to decrease as production increases.

20. LIFO is inappropriate where unit costs tend to decrease as production increases.

True False Answers—Conceptual

MULTIPLE CHOICE—Conceptual

21. Which of the following inventories carried by a manufacturer is similar to the merchandise inventory of a retailer?

a. Raw materials.

b. Work-in-process.

c. Finished goods.

d. Supplies.

22. Where should raw materials be classified on the balance sheet?

a. Prepaid expenses.

b. Inventory.

c. Equipment.

d. Not on the balance sheet.

23. Which of the following accounts is not reported in inventory?

a. Raw materials.

b. Equipment.

c. Finished goods.

d. Supplies.

24. Why are inventories included in the computation of net income?

a. To determine cost of goods sold.

b. To determine sales revenue.

c. To determine merchandise returns.

d. Inventories are not included in the computation of net income.

25. Which of the following is a characteristic of a perpetual inventory system?

a. Inventory purchases are debited to a Purchases account.

b. Inventory records are not kept for every item.

c. Cost of goods sold is recorded with each sale.

d. Cost of goods sold is determined as the amount of purchases less the change in inventory.

26. How is a significant amount of consignment inventory reported in the balance sheet?

a. The inventory is reported separately on the consignor’s balance sheet.

b. The inventory is combined with other inventory on the consignor’s balance sheet.

c. The inventory is reported separately on the consignee’s balance sheet.

d. The inventory is combined with other inventory on the consignee’s balance sheet.

27. Where should goods in transit that were recently purchased f.o.b. destination be included on the balance sheet?

a. Accounts payable.

b. Inventory.

c. Equipment.

d. Not on the balance sheet.

28. If a company uses the periodic inventory system, what is the impact on net income of including goods in transit f.o.b. shipping point in purchases, but not ending inventory?

a. Overstate net income.

b. Understate net income.

c. No effect on net income.

d. Not sufficient information to determine effect on net income.

29. If a company uses the periodic inventory system, what is the impact on the current ratio of including goods in transit f.o.b. shipping point in purchases, but not ending inventory?

a. Overstate the current ratio.

b. Understate the current ratio.

c. No effect on the current ratio.

d. Not sufficient information to determine effect on the current ratio.

30. What is consigned inventory?

a. Goods that are shipped, but title transfers to the receiver.

b. Goods that are sold, but payment is not required until the goods are sold.

c. Goods that are shipped, but title remains with the shipper.

d. Goods that have been segregated for shipment to a customer.

31. When using a perpetual inventory system,

a. no Purchases account is used.

b. a Cost of Goods Sold account is used.

c. two entries are required to record a sale.

d. all of these.

32. Goods in transit which are shipped f.o.b. shipping point should be

a. included in the inventory of the seller.

b. included in the inventory of the buyer.

c. included in the inventory of the shipping company.

d. none of these.

33. Goods in transit which are shipped f.o.b. destination should be

a. included in the inventory of the seller.

b. included in the inventory of the buyer.

c. included in the inventory of the shipping company.

d. none of these.

34. Which of the following items should be included in a company’s inventory at the balance sheet date?

a. Goods in transit which were purchased f.o.b. destination.

b. Goods received from another company for sale on consignment.

c. Goods sold to a customer which are being held for the customer to call for at his or her convenience.

d. None of these.

Use the following information for questions 35 and 36.

During 2012 Carne Corporation transferred inventory to Nolan Corporation and agreed to repurchase the merchandise early in 2013. Nolan then used the inventory as collateral to borrow from Norwalk Bank, remitting the proceeds to Carne. In 2013 when Carne repurchased the inventory, Nolan used the proceeds to repay its bank loan.

35. This transaction is known as a(n)

a. consignment.

b. installment sale.

c. assignment for the benefit of creditors.

d. product financing arrangement.

36. On whose books should the cost of the inventory appear at the December 31, 2012 balance sheet date?

a. Carne Corporation

b. Nolan Corporation

c. Norwalk Bank

d. Nolan Corporation, with Carne making appropriate note disclosure of the transaction

37. Goods on consignment are

a. included in the consignee’s inventory.

b. recorded in a Consignment Out account which is an inventory account.

c. recorded in a Consignment In account which is an inventory account.

d. all of these

S38. Valuation of inventories requires the determination of all of the following except

a. the costs to be included in inventory.

b. the physical goods to be included in inventory.

c. the cost of goods held on consignment from other companies.

d. the cost flow assumption to be adopted.

P39. The accountant for the Pryor Sales Company is preparing the income statement for 2012 and the balance sheet at December 31, 2012. Pryor uses the periodic inventory system. The January 1, 2012 merchandise inventory balance will appear

a. only as an asset on the balance sheet.

b. only in the cost of goods sold section of the income statement.

c. as a deduction in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

d. as an addition in the cost of goods sold section of the income statement and as a current asset on the balance sheet.

P40. If the beginning inventory for 2012 is overstated, the effects of this error on cost of goods sold for 2012, net income for 2012, and assets at December 31, 2013, respectively, are

a. overstatement, understatement, overstatement.

b. overstatement, understatement, no effect.

c. understatement, overstatement, overstatement.

d. understatement, overstatement, no effect.

S41. The failure to record a purchase of merchandise on account even though the goods are properly included in the physical inventory results in

a. an overstatement of assets and net income.

b. an understatement of assets and net income.

c. an understatement of cost of goods sold and liabilities and an overstatement of assets.

d. an understatement of liabilities and an overstatement of owners’ equity.

42. Dolan Co. received merchandise on consignment. As of March 31, Dolan had recorded the transaction as a purchase and included the goods in inventory. The effect of this on its financial statements for March 31 would be

a. no effect.

b. net income was correct and current assets and current liabilities were overstated.

c. net income, current assets, and current liabilities were overstated.

d. net income and current liabilities were overstated.

43. Green Co. received merchandise on consignment. As of January 31, Green included the goods in inventory, but did not record the transaction. The effect of this on its financial statements for January 31 would be

a. net income, current assets, and retained earnings were overstated.

b. net income was correct and current assets were understated.

c. net income and current assets were overstated and current liabilities were understated.

d. net income, current assets, and retained earnings were understated.

44. Feine Co. accepted delivery of merchandise which it purchased on account. As of December 31, Feine had recorded the transaction, but did not include the merchandise in its inventory. The effect of this on its financial statements for December 31 would be

a. net income, current assets, and retained earnings were understated.

b. net income was correct and current assets were understated.

c. net income was understated and current liabilities were overstated.

d. net income was overstated and current assets were understated.

45. On June 15, 2012, Wynne Corporation accepted delivery of merchandise which it pur-chased on account. As of June 30, Wynne had not recorded the transaction or included the merchandise in its inventory. The effect of this on its balance sheet for June 30, 2012 would be

a. assets and stockholders’ equity were overstated but liabilities were not affected.

b. stockholders’ equity was the only item affected by the omission.

c. assets, liabilities, and stockholders’ equity were understated.

d. none of these.

46. What is the effect of a $50,000 overstatement of last year’s inventory on current years ending retained earning balance?

a. Understated by $50,000.

b. No effect.

c. Overstated by $50,000.

d. Need more information to determine.

47. Which of the following is a product cost as it relates to inventory?

a. Selling costs.

b. Interest costs.

c. Raw materials.

d. Abnormal spoilage.

48. Which of the following is a period cost?

a. Labor costs.

b. Freight in.

c. Production costs.

d. Selling costs.

49. Which method may be used to record cash discounts a company receives for paying suppliers promptly?

a. Net method.

b. Gross method.

c. Average method.

d. a and b.

50. Which of the following is included in inventory costs?

a. Product costs.

b. Period costs.

c. Product and period costs.

d. Neither product or period costs.

51. Which of the following is correct?

a. Selling costs are product costs.

b. Manufacturing overhead costs are product costs.

c. Interest costs for routine inventories are product costs.

d. All of these.

52. All of the following costs should be charged against revenue in the period in which costs are incurred except for

a. manufacturing overhead costs for a product manufactured and sold in the same accounting period.

b. costs which will not benefit any future period.

c. costs from idle manufacturing capacity resulting from an unexpected plant shutdown.

d. costs of normal shrinkage and scrap incurred for the manufacture of a product in ending inventory.

53. Which of the following types of interest cost incurred in connection with the purchase or manufacture of inventory should be capitalized as a product cost?

a. Purchase discounts lost

b. Interest incurred during the production of discrete projects such as ships or real estate projects

c. Interest incurred on notes payable to vendors for routine purchases made on a repetitive basis

d. All of these should be capitalized.

54. The use of a Discounts Lost account implies that the recorded cost of a purchased inventory item is its

a. invoice price.

b. invoice price plus the purchase discount lost.

c. invoice price less the purchase discount taken.

d. invoice price less the purchase discount allowable whether taken or not.

55. The use of a Purchase Discounts account implies that the recorded cost of a purchased inventory item is its

a. invoice price.

b. invoice price plus any purchase discount lost.

c. invoice price less the purchase discount taken.

d. invoice price less the purchase discount allowable whether taken or not.

Use the following information for questions 56 and 57.

During 2012, which was the first year of operations, Oswald Company had merchandise purchases of $985,000 before cash discounts. All purchases were made on terms of 2/10, n/30. Three-fourths of the items purchased were paid for within 10 days of purchase. All of the goods available had been sold at year end.

56. Which of the following recording procedures would result in the highest cost of goods sold for 2012?

1. Recording purchases at gross amounts

2. Recording purchases at net amounts, with the amount of discounts not taken shown under “other expenses” in the income statement

a. 1

b. 2

c. Either 1 or 2 will result in the same cost of goods sold.

d. Cannot be determined from the information provided.

57. Which of the following recording procedures would result in the highest net income for 2012?

1. Recording purchases at gross amounts

2. Recording purchases at net amounts, with the amount of discounts not taken shown under “other expenses” in the income statement

a. 1

b. 2

c. Either 1 or 2 will result in the same net income.

d. Cannot be determined from the information provided.

58. When using the periodic inventory system, which of the following generally would not be separately accounted for in the computation of cost of goods sold?

a. Trade discounts applicable to purchases during the period

b. Cash (purchase) discounts taken during the period

c. Purchase returns and allowances of merchandise during the period

d. Cost of transportation-in for merchandise purchased during the period

S59. Costs which are inventoriable include all of the following except

a. costs that are directly connected with the bringing of goods to the place of business of the buyer.

b. costs that are directly connected with the converting of goods to a salable condition.

c. buying costs of a purchasing department.

d. selling costs of a sales department.

P60. Which inventory costing method most closely approximates current cost for each of the following:

Ending Inventory Cost of Goods Sold

a. FIFO FIFO

b. FIFO LIFO

c. LIFO FIFO

d. LIFO LIFO

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 2 Chapter 9 Homework

1) Floyd Corporation has the following four items in its ending inventory. Determine the final lower-of-cost-or-market inventory value for each item.

2) Bell, Inc. buys 1,000 computer game CDs from a distributor who is disconnecting those games. The purchase price for the lot is $8,000.Bell will group the CDs into three price categories for resale, as indicated bellow. Determine the cost per CD for each group, using the relative sales value method.

3) Boyne Inc. had beginning inventory of $12,000 at cost and $20,000 t retail. Net purchase were $12,000 at cost and $17,000 at retail. Net markups were $10,000; net markdowns were $7,000; and sales revenue was $147,000.compute ending inventory at cost using the conventional retail method.

4) Marvin Gaye Company has been having difficulty obtaining key raw materials for its manufacturing process. The Company therefore signed a long-term non cancelable purchase commitment with its largest supplier of this raw material on November 30, 2014,at an agreed price of $400,0000. At December 31, 2014, the raw material had declined in price to $365,000. What entry would you make on December 31, 2014, to recognize these facts?

5) Tim Legler requires an estimate of the cost of goods loat by fire on March 9. Merchandise on hand on January 1 was $38,000. Purchases since January 1 were $72,000; freight-in $3,400; purchases returns and allowances, $2,400. Sales are made at 33 1/3% above cost and totaled $100,000 to March 9. Goods coasting $10,900 were left undamaged by the fire; remaining goods were destroyed. (a). compute the cost goods destroyed. (b). compute the cost goods destroyed, assuming that the gross profit 33 1/3% of sales.

6) Presented below is information related to Ricky Henderson Company. Compute the inventory by the conventional retail inventory method.

7) The inventory section of Maddox’s balance sheet as of November 30,2014, including required foot notes, is presented below are the inventory section supporting calculations.

8) All of the following are key similarities between GAAP and IFRS with respect to accounting for inventories except:

9) Starfish Company (a Company using Gap and LIFO inventory method) is considering changing to IFRS and the FIFO inventory method. How would a comparison of these methods affect Starfish’s financials?

10) Assume that Darcy industry had the following inventory values.

1. Inventory cost (on December 31,2014)$1,500

2. Inventory sales value (on December 31,2014)$1,350

3. Inventory net realizable value (on December 31,2014)$1,320

Under IFRS, what is the inventory carrying value on December 31, 2014 ?

11) Under IFRS, agricultural activity results in which of the following types of assets?

1. Agricultural produce

2. Biological assets

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 3 Chapter 10 Homework

1) Hanson Company is constructing a building. Construction begins on February 1 and was completed on December 31. Expenditure were $1,800,000 on march 1, $1,200,000 on June 1, and $3,000,000 on December 31. Compute Hanson’s weighted-average accumulated expenditure for interest capitalization purposes.

2) Mehta Company traded a used welding machine (cost $9,000, accumulated depreciation $3,000) for office equipment with an estimated fair value of $5,000. Mehta also paid $3,000 cash in the transaction. Prepare the journal entry to record the exchange.

3) Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2011. Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance is accumulated depreciation of $8,400 at December 31, 2014. The machinery is sold on September 1, 2015, for $10,500. Prepare journal entries to (a) update depreciation for 2015 and (b) record the sale.

4) Martin Buber co. purchased land as a factory site for $400,000. The process of tearing down two old buildings on the site and constructing the factory required 6 months. The company paid $42,000 to raze the old buildings and salvaged lumber and brick for $6,300. Legal fees of $1,850 were paid for title investigation and drawing the purchase contract. Martin Buber paid $2,200 to an engineering firm for a land survey, and $68,000 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost $1,500, and a liability insurance premium paid during construction was $900. The contractor’s charge for construction was $2,740,000. The company paid the contractor in two installments:$1,200,000 at the end of 3 months and $1,540,000 upon completion. Interest costs of $170,000 were incurred to finance the construction. Determine the cost of the land and the cost of the building as they should be recorded on the books of Martin Buberk Co. assumes that the land survey was for the building.

5) Ben Sisko Supply Company, a newly formed corporation, incurred the following expenditure related to land, to Buildings, and to machinery and equipment. Determine the amounts that should be debited to land, to buildings, and to machinery and equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation.

6) On December 31, 2013, Main Inc. borrowed $3,000,000 at 12% payable annually to finance the construction of a new building. In 2014, the company made the following expenditures related to this building: March 1, $360,000; June 1, $600,000;$1,500,000; December 1, $1,500,000. The building was completed in February 2015. Additional information is provided as follows.

7) Determine the amount of interest to be capitalized in 2014 in relation to the construction of the building.

8) Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2014.

9) Busytown Corporation, which manufactures shoes, hired a recent college graduate to work in accounting department. On the first day of work, the accountant was assigned to total a batch of invoices with the use of an adding machine. Before long, the accountant, who had never before seen such a machine, managed to break the machine. Busy town Corporation gave the machine plus $340 to Disk Business machine Company (dealer) in exchange for a new machine. Assume the following information about the machines. For each company, prepare the necessary journal entry to record the exchange.

10) Under IFRS, Sampson company, who has a non-current asset which has been classified as held-for-sale, should

11) Miller Company, a company who uses IFRS reporting standards, sells a non-current asset classified as held-for-sale. Which of the following statements is true regarding the treatment of a gain on a subsequent increase in the fair value less cost?

12) Damson Company, a company who uses IFRS reporting standards, has a non-current asset that has been classified as held-for-sale. When the asset no longer meets this definition, Danson should

13) Elton Industries, a company who uses IFRS reporting standards, has asset and liabilities of a disposal group classified as held-for-sale shown on its statement of financial position. Which of the following presents the best treatment for these?

14) Woodson Company, a company who uses IFRS reporting standards, has identified a group of plant assets for disposal. On January 1, 2014, the carrying value of these assets was $14.5 million. The assets were revalued to $13.5 million on January 5, 2014, when they were identified as property for the disposal group. In addition, Woodson thinks that it will cost $1.5 million to sell these assets. What carrying amount should these assets reflect for year-end financial statements to be prepared on January 10, 2014?

ACC 304 ACC304 ACC/304 ENTIRE COURSE HELP – STRAYER UNIVERSITY

ACC 304 Week 3 Chapter 9 Quiz (All Possible Questions)

1. A company should abandon the historical cost principle when the future utility of the inventory item falls below its original cost.

2. The lower-of-cost-or-market method is used for inventory despite being less conservative than valuing inventory at market value.

3. The purpose of the “floor” in lower-of-cost-or-market considerations is to avoid overstating inventory.

4. Application of the lower-of-cost-or-market rule results in inconsistency because a company may value inventory at cost in one year and at market in the next year.